Cost of Living Crisis (Study): 50% of Brits Admit to Cutting Back

It seems everywhere you turn nowadays; everything is on the rise from fuel and energy costs to household essentials like food and mortgages.

The cost-of-living crisis is ramping up and we look at some of the key problem areas as well as research that analysed ways in which many people are cutting back.

This article examines how people are saving money, some helpful tips to stay ahead of the crisis and what to expect if you’re a homeowner or saving for your first property.

Let’s untangle this mess.

What’s the Cost-of-Living Crisis?

In short, the cost-of-living crisis is an economic situation that is categorised by high inflation, stagnant wages/earnings and costs of goods and services rising.

All of these actions squeeze the Pound Sterling which results in it being devalued in other words, £1 today is worth less than it was in 2020.

For example, in 2020 you would be able to buy 2 bags of pasta with £1 whereas now you will find a bag of pasta costs closer to £1.

Currently, many economic factors have transformed our ability to afford what we want (or need) to buy:

- The war in Ukraine has throttled fuel supply.

- Governments have been overspending during the COVID-19 pandemic.

- Central banks have failed to make inflation targets and are slow to react.

These are the three major contributors to the cost-of-living crisis however, it is fair to say there are satellite problems that have impacted our ability to buy things:

- Brexit (while not a significant cause) has caused some supply chain issues and increased the cost of importing and exporting.

- Property market boom as a result of the Stamp Duty holiday introduced during the pandemic.

- Increased cost of borrowing.

War in Ukraine and Fuel Supply

The energy crisis has long been brewing, but the devasting invasion of Ukraine by Russia has become a flashpoint.

When Russia invaded Ukraine, it was immediately apparent there would need to be global action to sanction Russia, but this caused a big headache for many countries including Britain which rely on Russian gas.

Months later and we are seeing the impact of that supply chain being hit and fuel prices are rising astronomically as we try to power our cars and homes.

Government Overspending During COVID Pandemic

Government policy during the COVID-19 pandemic was to lockdown and keep people at home. The issue is that many of us rely on leaving our homes to earn money so that we can support ourselves and our families.

When Britain was placed in lockdown the government needed to act to remedy the loss of earnings people faced and introduced various schemes to support individuals and businesses.

The problem is that this grew the government’s debt and has resulted in a deficit on their books. Something they have been trying to claw back by changes to taxation and cutting public sector spending.

Free consultations are available in the UK.

Get Started NowCentral Banks and Inflation

You might not be aware, but central banks like the Bank of England have a specific target for inflation.

In the Bank of England’s case, they have been targeted to keep inflation to a maximum of 2% per year. Unfortunately, even before this crisis, they have failed year on year to meet this target and inflation has been growing annually.

They can take action on inflation by increasing the Bank of England base rate, something they have been loath to do but in recent months they have been taking small steps by increasing the base rate.

The problem isn’t yet in hand though as the Bank of England hasn’t made the increases that need to be made to keep inflation in check so more financial pain could be on the horizon.

Brexit

It’s always easy to point the finger at Brexit and the media are always quick to do so. The truth is, Brexit has had little impact overall on the economy especially when other major global events are having a far greater impact.

Where Brexit has had an impact is supply lines. With more paperwork needed to handle imports from the EU, it is causing delays that weren’t there before.

This means the cost of importing the goods (aside from new levies) is rising and with many EU goods in our supermarkets, our food and other household goods are increasing in price.

Property Market

You might mistakenly believe when the economy suffers that all areas of the economy trend downwards.

This hasn’t been the case, mainly as a result of controversial government policy with stamp duty reductions offered during the pandemic that resulted in people clambering to buy and sell property.

Now the so-called stamp duty holiday has ended the market finds itself in an inflated position with property prices currently at an all-time high.

This means that anyone looking to move home or get a mortgage on a property is going to struggle considerably in the current market compared to someone who bought before (and during) the pandemic.

Increased Cost of Borrowing

Something that will begin to play out over the next year (especially in the mortgage market) is the higher interest rates lenders need to put on their loans.

This is because the banks borrow money at an interest rate aligned with the Bank of England base rate, and when the base rate increases, the cost of them borrowing money tends to correlate with it.

They are in the business of making money, so they pass on these increased costs to the consumer.

In the UK, many who have already had mortgage offers have had products pulled and revised offers sent out with higher interest rates. Going forward the old cheaper mortgage products will be phased out with more expensive ones becoming the norm (at least until the economy recovers).

How All of This Ties Together to Create a Real Problem for Everyday People

Above we have discussed many different aspects of global news that can sometimes seem far removed from our ordinary everyday lives.

These global problems have a drastic effect on our daily routine though and below is a list of the areas that have been impacted:

- Petrol/Diesel Prices Oil prices have been rising for many years but there has been a steep increase in the last 6 months with it now costing on average £100 to fill up a family car.

- Food Britain relies on imports for many food products that we have become accustomed to. The abovementioned oil prices are increasing the cost of getting your food from farm to fork (haulage costs/duties) and the prices of everyday food items is increasing rapidly.

- Household Products For the same reason mentioned with food, household items are also increasing in price as the cost of production and supply are rising.

- Gas and Electricity The wholesale costs of energy have been rising for a few years now and even before the cost-of-living crisis really took hold, OFGEM had raised the price cap for energy companies. The price cap has been raised again since then with further rises expected in the next few months and consumers will find energy prices rising significantly over the next 12 months.

- Rental Costs and Mortgages Landlords have found their costs have increased and many are now trying to increase rents for their properties. This is sometimes due to energy costs if rent includes bills, but mostly to do with mortgages. If you have a tracker rate mortgage, your monthly payment will increase every time the Bank of England increases the base rate.

There are also other price increases for products and services that might be considered non-essential but help our overall wellbeing and lifestyle. For example, many of us like to travel overseas and the cost of holidays has risen mainly because airfares have risen.

What Our Clients Have To Say

A Study into How the Cost-of-Living Crisis is Affecting Us

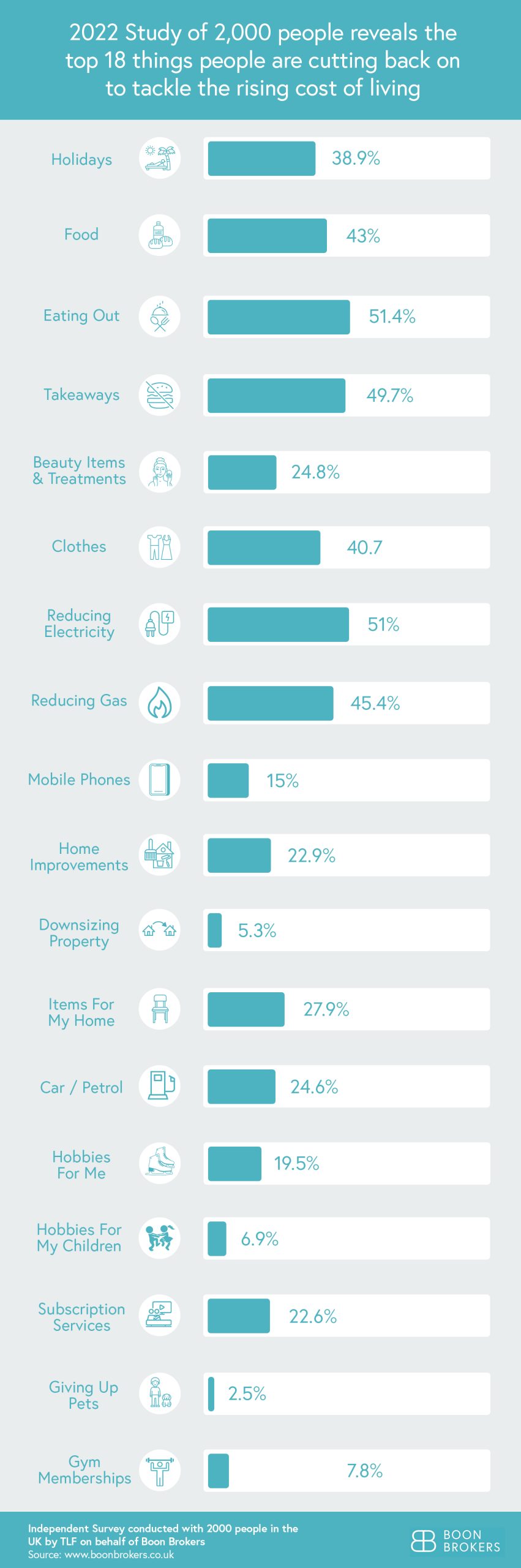

At Boon Brokers, we knew the cost-of-living crisis would have some detrimental impact on our customers, but we wanted to find out just how much of a problem it was.

To do this we conducted a survey of 2000 people to find out how they had adjusted their lifestyle and financial decisions as a result of the cost-of-living crisis.

The results were staggering to say the least and we were surprised to find that 50% of the people we surveyed had already made cutbacks on everyday spending, with some making large changes to combat the crisis.

The Results of the Boon Brokers Study

Of everyone surveyed, only 8% said they had no plans to make changes and reduce their outgoings.

In contrast, 92% of people surveyed said they were planning to make changes to reduce expenditure and 50% of everyone surveyed had already done so.

What’s interesting is many cutbacks are being made in areas where the cost-of-living crisis hasn’t yet taken hold demonstrating that there will be a snowball effect on the failing economy.

What Are People Cutting Back on?

Below is a list of the areas people intended to or were already cutting back on to reduce financial pressure.

- Eating Out (51%) The hospitality industry is vulnerable when the overall economy suffers as it is considered a ‘luxury’ industry that people can survive without. Eating out includes things like restaurant dining and grabbing a cup of coffee at Starbucks before work.

- Reducing Electricity Usage (51%) With energy prices rising at an eyewatering rate it is not a surprise that we are starting to look at reducing usage. This includes things like watching less TV and wearing clothes for longer to reduce running the washing machine.

- Takeaways (50%) This is similar to eating out, except people are using services like Deliveroo or Just Eat less than they used to.

- Reducing Gas Usage (43%) Basically households that use a gas boiler are looking to reduce the amount of time they are using it. Things like running central heating or bathing less regularly to cut down on hot water usage.

- Food/Groceries (43%) Many people are opting to buy cheaper brands with some going as far as changing their regular supermarket to a cheaper one. Companies like LIDL are currently running adverts advising people to save money by shopping with them instead of their other supermarket.

- Clothes (41%) Instead of buying new clothes, those surveyed indicated they would get more life out of their existing wardrobe. Highstreet clothes shops have already had a rough time of late and this crisis will compound issues for them further.

- Holidays (39%) We were surprised that over a third of people surveyed were making changes to their holiday plans. This could be opting for cheaper holiday destinations or avoiding a holiday altogether.

- Items for the Home (28%) This is a broad area that over a quarter of those surveyed indicated they were cutting back on. This includes the likes of tech, home decorations and buying plants for our gardens.

- Beauty Items/Treatments (25%) A quarter of those surveyed said they would be reducing expenditure around make-up and hair products as well as having haircuts or nails done less regularly.

- Car/Petrol (25%) This was surprising to us as we expected people to cut back on car usage with the high fuel prices. We do however rely on our cars for work, socialising and general travel so perhaps it isn’t too surprising most motorists are prepared to stomach the rising costs at least for the time being.

- Subscription Services (23%) People indicated they had either cancelled a subscription or were planning to cancel subscriptions for services like Netflix, Amazon Prime and Disney+.

- Hobbies (20%) Sadly many people feel their hobbies are a luxury and would rather save money on them than forgo cutting back in other areas.

- Mobile Phones (15%) For the most part, our phone contracts have a fixed price but for those who had the flexibility of topping up or were changing contract, there was an indication that they would look to cut expenditure here.

- Fitness/Gym Membership (10%) Those surveyed said they would be spending less on fitness or cancelling gym memberships that are on rolling contracts.

- Children’s Hobbies (7%) This could include reducing days out for our children or cutting back on expenditure on toys or things to keep the kids occupied.

There are also other areas people indicated that they would cut back on to help them combat rising costs. Activities like socialising with friends and family, reducing or stopping charity donations, or even giving pets up for adoption are all featured in our survey.

It is fair to say that with such heart-breaking outcomes being discussed that people are beginning to realise how serious the cost-of-living crisis is and are prepared to take action to secure their future financial wellbeing.

Our Survey The Impact on Mortgages and Property

1 in 20 people surveyed (5%) stated that they were looking to downsize their home in order to further cut costs.

Downsizing can help in a number of ways with this specific crisis.

- You can reduce energy costs by buying a smaller property that uses less electricity and gas.

- You can move to a location that is closer to work and cut down on fuel costs.

- You can make large savings on your monthly mortgage expenditure or free up cash tied in your existing equity.

Mortgages were a big concern for those surveyed and just over a quarter of mortgagees (26%) stated they were concerned they wouldn’t be able to keep up with their mortgage payments.

Free consultations are available in the UK.

Get Started NowMortgage Tips and Cost of Living Crisis

Because mortgages are so important and a large portion of those surveyed indicated they had or expected problems to arise with their mortgage, we have created this checklist to help:

- Check what rate you’re on. Currently, fixed-rate mortgages are preferable. If you’re on a tracker rate, check when the deal expires and make preparations to remortgage on to a new deal.

- If you’re on a Standard Variable Rate (SVR) then you should contact a mortgage broker and discuss options available to remortgage your property. SVRs are notoriously costly and with rates rising, your variable rate will almost certainly be increasing too.

- If you anticipate missing a payment, contact your lender in the first instance many lenders have schemes like payment holidays to help you get back on your feet during times of hardship.

- Even if a payment holiday isn’t available to you, your lender may have other options that they can offer to help ease your problems. They have a responsibility to help you wherever possible.

Missing Mortgage Payments

5% of those surveyed had admitted to missing a mortgage payment already. Missing mortgage payments can have a big impact on your life and should be avoided at all costs.

Missing payments will cause a lender to become concerned about your ability to pay and can lead to repossession.

Repossessions are unfavourable for all involved and a lender will primarily be concerned with retrieving the basic costs of the mortgage to do this they typically list the property in an auction.

Auctions are designed to sell properties in 30 days and a property sold at auction will likely not have the same value as a standard property sale. This means when all is said and done, you might be left without a home and no money back from the sale of the property.

If you anticipate missing a mortgage payment, get in contact with your lender and mortgage broker and see if there is something they can do to help you. For example, your broker might see that you’re on a SVR mortgage and be able to cut your mortgage costs by remortgaging you onto a fixed rate deal.

Remortgaging and Rising Interest Rates

28% of the people we surveyed indicated they were worried that the rates would rise so much by the time their mortgage deal ended that remortgaging wouldn’t be an affordable option.

This is a catch-22 situation and is commonly known as a mortgage trap, where people find themselves unable to remortgage.

Speak to Boon Brokers about remortgaging as it will almost always be preferable to remortgage than allow your deal to expire and go onto a lenders SVR.

Even if you think you won’t be able to remortgage, Boon Brokers is a whole of market mortgage broker, and we have access to an extensive range of products and lenders we may well be able to assist you where other brokers have failed.

What’s more, if the worst-case scenario occurs and you fail to find a remortgage, Boon Brokers will advise you on practical steps you can take to get a remortgage in the soonest possible time helping you escape that mortgage trap faster.

Remortgaging Could Be the Best Option Now

The truth is, no one has a crystal ball, and we don’t know where interest rates will be in a year or a few years’ time.

If you are worried about your mortgage payments or you feel like there may be cheaper options available to you, now is the time to take action and contact Boon Brokers.

We will be able to look at your situation and your current product and then assess whether there are cheaper deals available to you.

A simple remortgage onto a cheaper deal could be the difference between cutting back on other things mentioned in our survey.

How are business owners affected by the cost of living crisis?

As part of the survey, Boon Brokers also questioned over 300 business owners on how the cost of living crisis is impacting their business and personal finances.

The results were deeply shocking.

15% of business owners say that the cost of living crisis is putting the survival of their business at risk, whilst 44% have had to pass price increases on to consumers.

Furthermore, 25% of business owners have had to reduce their personal income.

These are very worrying statistics. Inflation and increased energy prices has really taken its toll on businesses throughout the country.

10 Practical Tips to Help with the Cost-of-Living Crisis

Below we have compiled a list of useful and practical tips to help you reduce costs without too much pain during the cost-of-living crisis.

- Pay Off Debt if You Can Most of us won’t be in the position to pay down debt, but if you are, then now is a great time to make a payment. This is for two reasons, the first being that savings rates are often far less than debt interest rates. The second is that with inflation currently sitting at around 9%, saving money is eroding your actual spending power so clearing debt makes sense in this respect too.

- Check Energy Prices The truth is the market is quite uncompetitive at the moment, but you should make sure you’re on the cheapest possible tariff. Simply using a free comparison service to switch energy providers can save you hundreds each year.

- Switch Supermarkets Most middle to high-end supermarkets stock the same produce, sourced from the same location as cheaper supermarkets. Supermarkets rely on brand loyalty to keep you coming back and you will often be paying inflated prices for products that will be cheaper elsewhere.

- Manage Your Subscriptions Most online banking services allow you to do this through your mobile application. Go through the subscriptions you have and cancel the ones you can do without. Month on month you might not notice a difference, but over a year this could save you hundreds.

- Avoid Short Car Journeys The AA recommends that drivers walk instead of drive at the moment, this is because short journeys often burn fuel at a higher rate than long trips and the cost of making these trips adds up significantly.

- Shop Around We all need to buy items over time, and it goes without saying that you won’t want to go without something important. You should shop around online to find the cheapest price for anything you wish to buy. Most online retailers also have offers, deals and promotional codes that can be used when spending with them.

- Consider Downsizing – Moving home can be daunting and stressful but the truth is it is far more stressful to worry about making ends meet month on month. Whether you rent or own a property, you could find a more suitable property that saves you a lot of money every month.

- Switch Insurance, Savings Accounts, Contracts You might not realise but many building societies and smaller banks offer better value for money savings accounts compared to larger institutions. There is also a lot of competition for business among insurers and phone contract providers. Look at where you can save money on any contract you have the flexibility to switch from.

- Check Benefit Eligibility The government provides all kinds of financial assistance including specialist savings accounts. Look at what benefits are available to you, what payments you qualify for and whether there are government products like Help to Save you can make use of.

- Seek Expert Help from Boon Brokers.

Boon Brokers is a whole of market mortgage, insurance and equity release broker. We offer fee FREE advice and can help you if you’re struggling with ongoing mortgage or insurance payments.

Contact Boon Brokers today to see how we can help you.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- How To Get A Mortgage With Bad Credit

- The Mortgage Underwriting Process

- Reasons Why Mortgage Applications Are Declined

- Preparing For An Interest Rate Rise

- How To Buy A House After Lockdown

- Reasons To Review Your Mortgage Regularly

- How To Improve Your Chances Of Getting A Mortgage

- Reduce Mortgage Term Or Overpay

- How To Avoid Early Repayment Charges

- What Proof Of Income Is Needed For A Mortgage?

- The Mortgage Underwriting Process

- Should I Use A Broker Or Go Direct?

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757