What is a Deed of Covenant During Conveyancing?

Buying a house can be one of the most stressful things that you undertake during your lifetime, especially when you get to the conveyancing stage.

Conveyancing is an integral part of the house-buying process, but you might find it takes longer than you expect and has aspects you may not understand fully.

One of the aspects that you may encounter during the conveyancing process is a Deed of Covenant. These can be complicated and have far reaching consequences when buying a house.

If you’re struggling to get to grips with a Deed of Covenant, this guide will give you all you need to know and help you make the best decision when buying a house.

What is a Deed of Covenant?

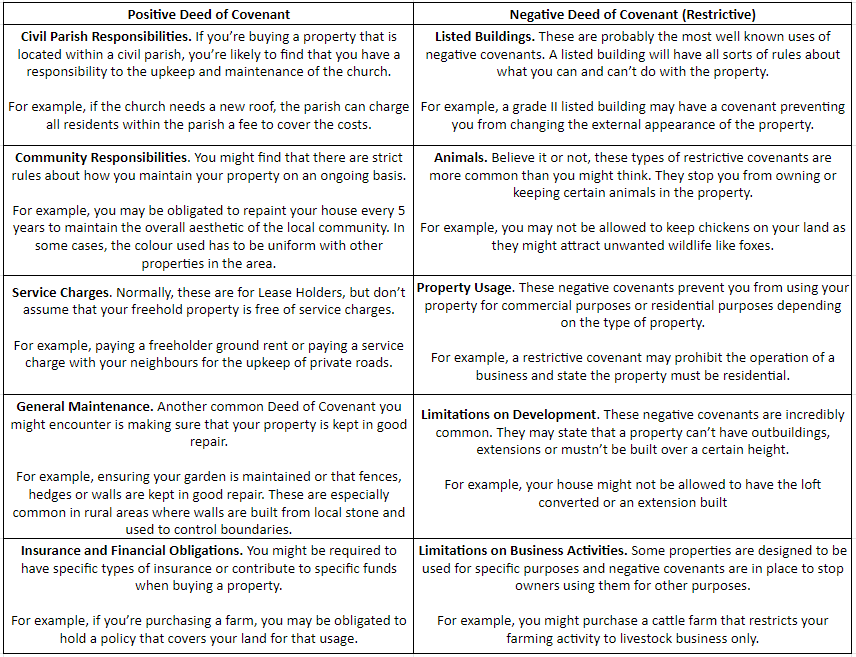

There are typically two types of Deed of Covenant.

- Negative Deed of Covenant These are sometimes called Restrictive Deed of Covenants, and mainly cover legal restrictions that you have to abide by when you own a property.

- Positive Deed of Covenant These Deeds of Covenant will outline your legal obligations when you own a property.

Most Deeds of Covenant will be existing on your property deeds and the rights and responsibilities will be carried forward when you buy the property.

Sometimes though, Deeds of Covenant will be added during the conveyancing process, especially where law changes mean that Deed of Covenant needs to change too.

In the simplest terms, a Deed of Covenant is a legal responsibility that you have when owning a property.

The Deed of Covenant will be kept on your property deeds and can be accessed via the Land Registry.

If your Deed of Covenant is around ownership, maintenance and responsibilities related to boundaries, you may find that Land Registry records are incomplete and in these cases will need to try and access your original property deeds.

All other Deeds of Covenant will be accessible through the Land Registry and most boundary Deeds of Covenant are updated there too, though not all.

What Does a Deed of Covenant Typically Cover?

Now you have got to grips with Deeds of Covenant as a concept, let’s look at what they are typically used for and why.

As you have probably gathered, Deeds of Covenant can be extremely varied and have big financial implications in the future.

When going through the conveyancing process, your conveyancers will advise you of any Deed of Covenant that exist on your property deeds as well as any that may need to be added.

It is incredibly important that you take the time to read through your responsibilities and restrictions because these can cause major problems in the future if you’re unprepared.

This is especially the case for Deeds of Covenant which require you to pay money.

There have been many instances of civil parishes raising thousands of pounds from local residents to repair churches and these monetary demands can come unexpectedly and at any time.

Free consultations are available in the UK.

Get Started NowIs There a Fee for a Deed of Covenant?

Now we have moved onto the money side of Deeds of Covenant, you may be wondering if there are fees involved with having a Deed of Covenant.

The answer here is yes, there will likely be a fee added to your conveyancing fee, and these can range depending on the type of Deed of Covenant.

These fees normally reflect how complicated the Deed of Covenant is and how much additional work the conveyancer must do.

Ordinarily, Deed of Covenant fees from conveyancers don’t exceed £300, but in rare cases (especially with listed properties) this fee can be higher.

There may also be other fees charged when issuing a Deed of Covenant, specifically if you’re looking to buy a leasehold property.

For example, leaseholders may be charged a fee by the freeholder for issuing the Deed of Covenant.

Am I Required to Sign a Deed of Covenant?

A Deed of Covenant is a contractual agreement between you and whoever is enforcing the covenant. This means you will need to sign and agree to the terms of the Deed of Covenant and accept the responsibilities you have when buying a property.

Do I Have to Sign a Deed of Covenant?

No, you don’t have to sign a Deed of Covenant and you don’t need to enter into the agreement. With that said, a property purchase is normally contingent on you agreeing to sign a Deed of Covenant if it exists.

That means by not signing you should be prepared for the eventuality that you will not be able to buy the property.

In nearly all cases, declining to sign a Deed of Covenant will mean not being able to buy that property.

Before you sign, make sure that you have fully understood all of the responsibilities you have in the Deed of Covenant.

If you’re unsure of your responsibilities or you think future plans will impact your ability to keep a Deed of Covenant you should discuss this with your conveyancer.

Deed of Covenants can be extremely complicated things, and a planned future extension of your property might seem okay when reading the document initially but may be prohibited by other clauses in the deed.

In short, it is your responsibility to make sure you comply in full with a Deed of Covenant.

What Our Clients Have To Say

Who Can Witness the Signing of a Deed of Covenant?

When signing a Deed of Covenant, you will need to have someone witness your signature. They will then need to countersign to say they have witnessed the signature.

Fortunately, almost any adult can witness the signature to a Deed of Covenant providing that they are not party to the deed and have the mental capacity to do so.

If you want your spouse to sign as a witness this is possible as long as they will not be on the property deeds and under the same obligations as you with regards to the Deed of Covenant.

If your intended witness is also signing the deed elsewhere, you will need to find another witness.

What Happens After I Sign a Deed of Covenant?

There are a few things that happen after the signing of a Deed of Covenant.

- The conveyancing process will continue with a view to exchanging and completing on the property sale.

- You will be legally bound by the terms of the Deed of Covenant you have signed.

- You may need to wait for the freeholder to sign their end of the Deed of Covenant if you’re a leaseholder (or any other interested parties). This can sometimes lead to unexpected delays with conveyancing.

- You can check your property deeds at any point in the future to re-read the Deed of Covenant you have signed and recheck any obligations you have as a result.

Once a Deed of Covenant is enacted, you will have to make sure that you’re abiding by the rules set out in it.

What Happens if I Break a Deed of Covenant?

You might be wondering how flexible Deed of Covenants are and whether they’re watertight when it comes to the law.

The truth is, enforcing a Deed of Covenant is something that is taken very seriously. The penalties for breaking Deeds of Covenant are often high.

For example, if a court finds you to have broken a Deed of Covenant, they may award money to the claiming party as well as ensuring that you abide by it in the future.

In some cases, the court might deem that the Deed of Covenant has been broken so severely that they award an injunction.

A good example of this is if you have built an extension on the property that then needs to be demolished in order to restore the property to its original state.

As you can probably imagine, breaking a Deed of Covenant can be extremely costly and claims often run into high money figures.

Can I Get Out of Deed of Covenant?

The good news is that in some cases you may be able to remove a Deed of Covenant. Normally this is done by you paying the person/party who holds the covenant to remove it.

For example, you might wish to remove the financial obligation to the parish and remove the covenant from your deeds.

The parish may then set a monetary figure that you can pay to remove the Deed of Covenant.

It is worth bearing in mind that interested parties will often charge you a premium to remove a Deed of Covenant as they normally have a financial interest in it remaining in force.

In rare circumstances, you might be able to petition the court to remove a Deed of Covenant if you feel it is unfair in law.

Unfair in law doesn’t mean that you think it is unfair, rather that the Covenant itself is either unlawful or contradicts existing law.

These types of claims are highly specialised, and you will again need to factor in the costs of removing a Deed of Covenant in this way.

Typically, it is often best and most cost effective for you to keep the terms of the agreement you have made. If you feel you will be unable to, then it is best not to sign the Deed of Covenant in the first place.

Conclusion

Deeds of Covenants are legal documents that accompany some property purchases. They outline the rights and responsibilities of property owners.

They can be complicated to understand, and you may need specialist advice when buying a property.

There are also Deed of Covenant insurance policies available to better protect you when signing these agreements.

If you have any further questions about Deeds of Covenant or any other aspect of the property buying process, speak to us at Boon Brokers for a FREE, no obligation consultation.

Boon Brokers is a whole of market mortgage, insurance and equity release broker and we would love to hear from you today!

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- What Is A Mortgage In Principle?

- Should I Use A Broker Or Go Direct?

- How To Get A Mortgage After Bankruptcy

- What Is A Key Facts Illustration?

- What Is A Guarantor Mortgage

- The Mortgage Underwriting Process

- What Is A 100% Mortgage

- Should I Buy A House At Auction?

- How To Improve Your Chances Of Getting A Mortgage

- Everything You Need To Know About Buy To Let

- Choosing A Mortgage Broker

- How Long Does A Mortgage Application Take?

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757