Equity Release Companies to Avoid

In the realm of equity release, caution is paramount, as not all companies operate with the same level of transparency and integrity. As homeowners explore the option of unlocking the value of their property, the landscape is dotted with companies that may pose risks and pitfalls.

In this article, we summarise the different types of equity release options and provide guidance on how to identify the equity release companies you need to avoid.

Types of equity release

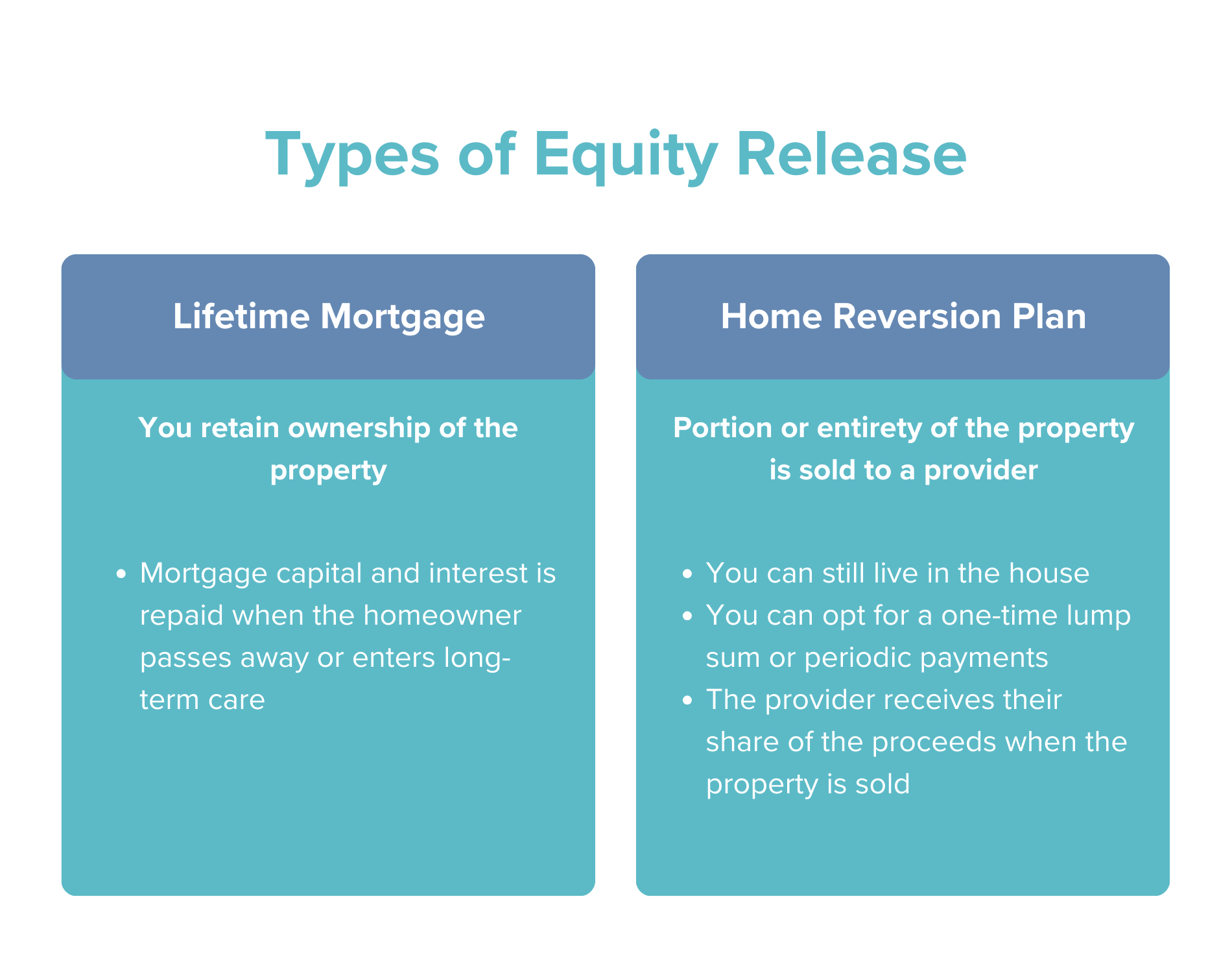

There are two types of equity release:

Lifetime mortgage

A lifetime mortgage is a form of equity release where the homeowner retains ownership of the property. The mortgage capital and interest is then repaid when the homeowner passes away or enters long-term care.

Typically, with a lifetime mortgage, you borrow up to 50% of the property value and are able to live in the property until you die, or the property is sold if you move into long-term care. This type of equity release is the most commonly used.

Home reversion

A home reversion plan involves selling a portion or the entirety of the property to a provider while allowing the individual to still live in the home.

They can opt for a one-time lump sum or periodic payments, and the provider receives their share of the proceeds when the property is eventually sold.

Free phone and video consultations are provided in the U.K.

Get StartedWho is equity release available to?

Equity release is typically for individuals aged 55 or older (some products may require 60 or 65 and above) who own their home outright or have minimal mortgage remaining.

Many equity release providers will require a minimum property minimum value of £70,000.

The lender may also take into account the property’s condition. Properties that require expensive repairs or other work before being sold might not be accepted.

In some cases, the lender could specify that repairs must be completed before agreeing to the equity release.

Are Equity Release schemes safe?

Ensuring the safety of equity release schemes depends on careful consideration and thorough research. While legitimate equity release schemes can provide financial relief, it is essential to choose reputable and regulated providers. The safety of these schemes lies in opting for companies overseen by regulatory bodies, such as the Financial Conduct Authority (FCA) and those affiliated with industry councils like the Equity Release Council (ERC). Checking customer reviews can also help assess the reliability of the scheme.

See What Our Clients Have To Say

Which Equity Release companies should you avoid?

It is crucial to avoid equity release companies not regulated by the Financial Conduct Authority (FCA) or associated with the Equity Release Council (ERC). Proceeding with such firms poses risks, which we discuss below. To prevent potential scams, be cautious of financial advisors or brokers not prioritising your interests, as they are your first contact before proceeding with equity release.

That is why it is strongly advised to conduct thorough research on your own. Further information can be found in our article addressing the mis-selling of equity release.

How to find a good lender

Deciding on a lender is a very important decision and you should take the following into consideration:

Are they registered with FCA? Members of ERC?

The first step to finding a good lender is to ensure that they are registered with the FCA and they are a member of the Equity Release Council. This means that they are regulated and offers you more protection compared to borrowing from an unregulated lender.

If you do not go with an FCA registered lender, you are at risk of being mis-sold a product without any rights to compensation.

Lenders who are members of the Equity Release Council will offer:

- A no negative equity guarantee.

- Capped or fixed interest rates.

- Sensible, competitive interest rates.

- Sensible early settlement fee structures.

- The right to remain in your property for life.

- The right to move to another property.

One of the issues that some people find when they take out an equity release product, is that they are unable to move to another property. Even if you think you will not want to move property, it is important to have the option, as your circumstances may change over the loan term.

Reputation

After confirming that an equity release company is regulated, the next step is to assess its reputation and historical performance. A notable red flag could be a significant amount of negative customer feedback or numerous unresolved complaints. Opting for companies with positive reviews is the safest course of action.

What are the costs?

The costs will vary between different lenders, but each lender should be able to provide you with a breakdown so you can compare the options.

This is where using a broker can be really helpful, as they can compare the different options available on the market for you. They can also explain the calculations to find the most suitable product for your circumstances.

Are there any early repayment charges? If so, how much?

Some companies have high early repayment charges, so this is another important consideration before taking out a product.

Offering loans before knowing your circumstances?

Another big red flag is if a company offers you a large loan sum, without having collated the information regarding your circumstances and specific financial situation.

If they offer you a large sum before you have provided them with much information, you should definitely be wary of them.

Alternatives to equity release

Before opting for equity release, it is important to consider all the different options that are available to you. The other types of financial options available are:

Remortgaging

Instead of taking out an equity release loan, you might want to consider remortgaging your property to release equity. When remortgagin, you will then pay back the loan via monthly repayments.

If your income can cover the monthly repayments, this helps to know how much inheritance you will be able to leave to your beneficiaries.

The downside to this is that the mortgage loan will need to be repaid as monthly payments. If you want to avoid monthly repayments, equity release could be a more suitable option.

Selling assets

If you have some valuable assets other than your home, it could be worth considering selling them.

This could be jewellery, a vehicle, equipment or anything else of value. You might have sentimental items that you were reluctant to sell but when considering an equity release loan, you may decide this is a more suitable choice.

If you are a retired couple with two cars, you could consider selling one of them and sharing a car to get a lump sum, plus the savings in running costs. Or maybe you have shared that you could sell.

These are all types of assets that you could think about selling rather than committing to taking out any type of financial commitment.

Downsizing

One of the most common ways to free up some money and reduce outgoings, is to sell your existing property and buy a smaller property that costs less. For example, if you live in the family home and your children have moved out, you might not need such a large house anymore.

You could downsize from a 3/4-bedroom property to a 1/2-bedroom property and have access to the profits made from the sale, minus the cost of the new property.

Downsizing also generally means you will have less maintenance and upkeep, such as gardening, cleaning, painting etc.

Besides your current situation, it is important to think about the next 10 or 15 years. While you may be fit and managing property upkeep easily now, this might change in the future. A bungalow may be more suitable to live in when you are older and cannot manage stairs.

A significant downside to downsizing is the need to go through the process of moving, finding a new property and handling tasks like valuation, surveys, and solicitor searches. You may also be very happy with the location of your existing property and want to stay in the neighbourhood that you are familiar with.

Is equity release right for you?

To determine if equity release is right for you, it is crucial to identify what your top priorities are.

Do you want to avoid making monthly repayments and stay in your home for as long as possible? Or do you want to make sure that your beneficiaries do not miss out on any possible inheritance?

Deciding whether equity release is right for you is a choice that should be very carefully considered, taking trustworthy, impartial advice from a reliable broker such as Boon Brokers.

Boon Brokers are members of the Equity Release Council and, unlike most brokers, do not charge any fees at any stage of the advice and arrangement process. Crucially, Boon Brokers also has whole-of-market access to lenders in the United Kingdom.

We can help you review your existing financial position and identify all of the available options, to find the most suitable product or solution.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Remortgage Or Equity Release

- Can I Sell My House If I Have Equity Release?

- How Much Does Equity Release Cost?

- What Happens On Death With Equity Release?

- How Does The ERC Protect You

- Can I Release Equity To Purchase A Second Home

- What Is Home Reversion?

- Releasing Equity To Help Child Buy Their First Home

- How Much Equity Can I Release?

- How Does Equity Release Affect Your Family

- Equity Release For A Buy To Let Mortgage

- Everything To Know About Equity Release

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757