How to Get a Mortgage with a New Job

When you start a new job, it can be a very exciting time, embarking on a new career and meeting new work colleagues. Whether you are changing career completely or switching to a similar job with a new company, there are plenty of reasons to look forward to the future.

However, if you are in the process of applying for a mortgage, or thinking about doing so in the next few months then starting a new job could impact your application. This information should help you understand how your mortgage application could be affected by starting a new job and how to work around potential problems so that you can go ahead with purchasing a property.

Short for time? Here’s a quick video explaining how to get a mortgage with a new job.

Can I get a mortgage with a new job?

Yes, it is certainly possible to get a mortgage with a new job, however there are several factors that lenders will consider to determine if they will lend the mortgage loan you. These factors include:

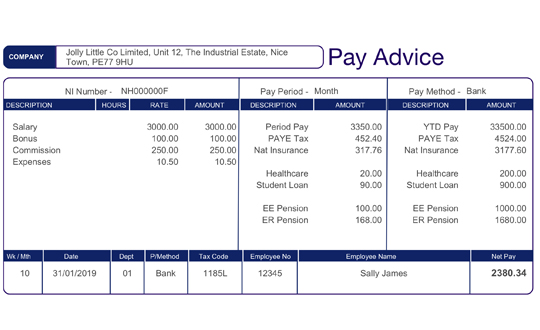

- Your previous work history, including payslips

- How long you’ve been at your current job

- If you have a probationary period

- If you are going self-employed

Providing proof of income through payslips

The standard requirement for payslips required to apply for a mortgage is 3 month’s worth of payslips and two year’s P60 forms. Some lenders may choose to undergo the mortgage process with a lower amount of payslips, however this is uncommon.

For many lenders, part of the lending criteria is that the applicant will provide payslips for the last three or more months to prove their income. If you have not been in work for a few months and are unable to provide three recent payslips, then this could cause a problem when applying for your mortgage. You could wait until you have been in the job for six months, so that you can provide the proof of income through payslips, although some lenders will accept a letter from your employer that confirms your salary instead.

Some people choose to delay their mortgage application if they are due to switch jobs or try to get a mortgage agreed before they start the job application process. However, if it is necessary to change jobs and buy a home at the same time, there are still solutions for this.

How long do you need to have been in a job for?

It is favourable to have been in your current job for a minimum of 3 months prior to applying for a mortgage. Most lenders will be hesitant to consider people who have recently started a new job.

If you have just recently started your new job, then you will not have the payslips to prove your new income. Many mortgage providers will only lend to an applicant that has been in a job for some time, as they see this as a more secure employment and therefore a lower risk of not being able to pay back their mortgage loan.

When you start applying to standard mortgage lenders, you might find that your application is declined because they are not prepared to lend until you have been in your job for longer. Each mortgage lender has different criteria, so it is worth checking with any lender before you start the application process.

If you get a declined mortgage then this could affect your credit report. Only apply for a mortgage if you are confident that the lender will accept you based on the length of time you have been in your role.

Mortgage lenders will also want to know whether your job involves a probationary period, for example if your contract could be terminated after the first six months. Another reason that lenders are less happy to provide mortgage loans to people in new jobs is because when redundancies are made, it is often the case that the newest employees are the ones who will be made redundant first.

A specialist broker should be able to identify the lenders that are most likely to accept your application when you have started a new job, factoring in all of the other relevant information that you provide them with.

Free phone and video consultations are provided in the U.K.

Get StartedWhat happens if my salary changes?

If your salary goes down

Similarly, if your new job means that you are taking a pay cut, you might find that lenders will not lend you as much as they would have been prepared to when you were on a higher salary.

If your new job involves different types of financial incentives like commission, bonuses or any other financial benefits then you should inform your mortgage lender to see if they include those arrangements when they are calculating your affordability.

Whilst some lenders might not count bonuses in your affordability calculations, other lenders will.

Other factors, such as how much deposit you are able to put down for the property will also be taken into account when a lender is deciding how much to lend to you, so saving up a bigger deposit will improve your chances of getting accepted.

If your salary increases

If your new job means that you will be earning more money, then this will increase your affordability calculation, so you could be able to buy a house that is priced higher than you could previously with your lower salary.

People often wait until they start a job where they have a bigger salary before they apply for a mortgage, so that they can afford a more expensive house, or they may need to wait until they earn a certain amount before they are able to afford a property at all.

When a mortgage lender is calculating your affordability to pay the loan, they will take into account your salary, age, outgoings, outstanding debt and they will also look at your credit history.

See What Our Clients Have To Say

Getting a mortgage when self-employed?

For people that are self-employed, this often means that they need to find a specialist mortgage lender that provides mortgages to self-employed people and will accept evidence other than payslips as proof of income, such as their accounts.

It can be quite difficult for self-employed people to get a mortgage as their income is often harder to prove and does not have payslips to show the monthly salary. Some lenders require several years of accounts as proof of income before they will be prepared to lend to self-employed workers.

If you are considering moving from being employed to starting up your own business, then you should consider the impact of doing so on your future mortgage applications. It is sometimes a good idea to take out a mortgage before you become self-employed to make the mortgage application process more straightforward.

However, if you are already self-employed, there are still many lenders that offer mortgages to self-employed people, but you would need to find a good broker such as Boon Brokers to help you to find the best mortgage lender for your situation.

Eligibility criteria for self-employed

There are certain factors that will impact whether a lender will be prepared to lend to a newly self-employed applicant. As it is difficult to project your potential future earnings, the other details that will usually be taken into account are:

- Your previous salary when you were employed

- How long you were employed for previously

- Whether you are a skilled worker with relevant qualifications/experience

- Your business strategy i.e. where your earnings will come from

- How long you have been self-employed for

If you have not been self-employed for long then a standard mortgage lender is more likely to decline your application, so finding a specialist broker is the best option in this situation. A specialist self-employed broker will be able to find the lenders that are more likely to accept you, based on your age, deposit, house value, employment status and credit history.

Remortgaging with a new job

When you already have a mortgage it can make it easier for lenders to assess how you’ve managed your mortgage payments. If you’ve consistently paid your mortgage on time you will have gained a lot of credibility, but if you’ve missed any payments this could hinder your remortgage application. Your credit score and the amount of equity you have in your property will affect your application.

If you are also not able to provide payslips, or changing to be self-employed then you could find it more difficult to have a new mortgage accepted. In this situation it could be better to wait until you are in the new job for longer, or to apply for a mortgage well before you change job/move into self-employment.

Speak to a mortgage adviser

Starting a new job will always make applying for a mortgage or any other type of credit more complicated. Moving jobs can be seen as a risk for lenders, as they want to see a history of employment and income. They need to be reassured that you will be able to repay your mortgage loan for the term that is arranged.

Whether you are starting a new career, or joining the many other people moving into self-employment, the best way to make sure that your mortgage application is accepted is to speak with a specialist broker.

If you would like to discuss your current job situation and find out how it will impact your ability to get a mortgage deal accepted, give us a call on 01508 483 983 or complete our Request a Callback form. Our specialist mortgage adviser have years of experience in helping people with new jobs get the best mortgage deals and we do it all for free!

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- How Does Being Self Employed Affect A Joint Mortgage?

- Everything You Need To Know About Buy To Let

- Getting A Joint Mortgage With Your Parents

- How Much Deposit Do I Need For A Mortgage

- What Proof Of Income Is Needed For A Mortgage?

- What Is A Guarantor Mortgage

- How To Get A £250,000 Mortgage

- How To Improve Your Chances Of Getting A Mortgage

- How To Get A Mortgage With Bad Credit

- How Do You Get the Best Mortgage Rate?

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757