What is a Joint Borrower Sole Proprietor Mortgage?

There are two main challenges that face borrowers when getting a mortgage. Saving a deposit can be incredibly difficult and once you have that out of the way, passing the affordability checks to borrow the amount you need is often just as problematic.

Whilst government schemes help first time buyers with deposits, they’re lacking when it comes to passing affordability requirements which has meant lenders have explored new ways to help you pass affordability checks.

One product that aims to tackle this issue is the joint borrower sole proprietor mortgage. But what is it, how can it help you and what are the risks and benefits? Our complete guide gives you all the information you need at a glance.

- An Overview of Joint Borrower Sole Proprietor (JBSP) Mortgages

- Who Benefits from a Joint Borrower Sole Proprietor Mortgage?

- How Does a Joint Borrower Sole Proprietor Mortgage Benefit Me?

- How Does a Joint Borrower Sole Proprietor Mortgage Allow Me to Borrow More?

- JBSP Mortgages to Get a Buy to Let Mortgage and Lower Taxes

- JBSP Mortgages and Asset Protection

- Can My Partner Take a JBSP Mortgage to Avoid Stamp Duty?

- JBSP Mortgages and Poor Credit History

- Pros of a JBSP Mortgage

- Cons of a JBSP Mortgage

- Conclusion

An Overview of Joint Borrower Sole Proprietor (JBSP) Mortgages

In simplest terms, a joint borrower sole proprietor (BJSP) mortgage allows you to borrow money with someone else (up to 4 people) without them being named on the property deeds.

This is mostly used by first time buyers who struggle to meet the affordability requirements set out by lenders, but they can be used in other ways as well.

Essentially by including someone else’s income to your mortgage application you will have a greater amount of leeway with the amount you can borrow.

This type of mortgage also means that repayments will be made easier as everyone included on the loan will be responsible for making the monthly payment, even if they aren’t listed on the property deeds.

How do JBSP Mortgages Differ from Joint Mortgages?

With a traditional joint mortgage (typically used by partners buying a house) both people listed on the mortgage will also be listed on the title deeds with joint ownership of the property.

With a JBSP mortgage, you could be on the mortgage with another person but only you own the property on the title deeds. This means that anyone else on the mortgage has no ownership interest in the property and you own the property outright.

You might be wondering what benefits this has for supporting borrowers, which is a valid question.

In short, the main advantage for supporting borrowers is the avoidance of having to pay the additional stamp duty surcharge or if they are already homeowners, it avoids the need to pay the second home stamp duty charge.

There are also a few other benefits which we will explore further in a bit.

Who Benefits from a Joint Borrower Sole Proprietor Mortgage?

If you’re the sole proprietor on a JBSP mortgage the likelihood is that you would be the person that benefits most from the mortgage.

There are three main reasons why you would benefit as the sole proprietor:

- With other people’s income contributed, your affordability should be boosted.

- All people listed on the mortgage are responsible for repaying the mortgage, so it can help if you’re worried about making monthly payments on your own.

- Yours will be the only name registered on the title deeds and you own the property.

The lender also benefits by offering JBSP mortgages as they are able to lend more and have more applicants which spreads the risk. This is because they’re lending across multiple people rather than hoping one person will be able to repay the loan.

As mentioned, there are also some benefits for other borrowers on the mortgage. The three most prominent benefits for borrowers who aren’t the sole proprietor are:

- Lower taxes on Buy to Let mortgages.

- Asset protection.

- Avoiding stamp duty liabilities.

How Does a Joint Borrower Sole Proprietor Mortgage Benefit Me?

To answer this question, it depends on whether you’re an additional borrower listed on the mortgage or if you’re going to be the sole proprietor on the mortgage.

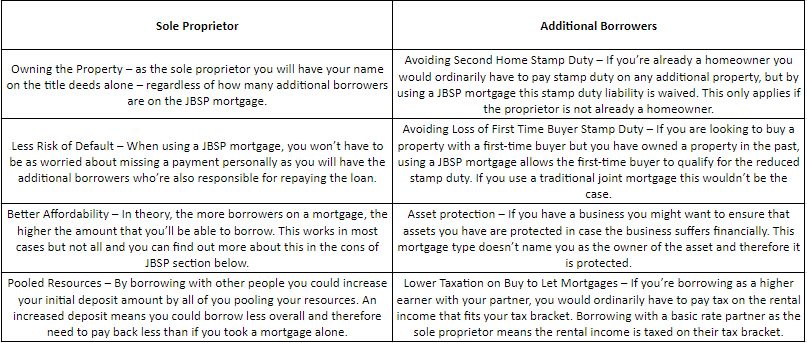

To explain in full, we have created a table to see the benefits at a glance.

Free consultations are available in the UK.

Get Started NowHow Does a Joint Borrower Sole Proprietor Mortgage Allow Me to Borrow More?

To explain how joint borrower sole proprietor mortgages work in more detail we will provide some examples of the features and benefits.

For example, if you’re looking to buy a house with an annual salary of £25,000 you will be able to borrow on average 4.5 times your salary (sometimes more, sometimes less depending on the lender).

This example puts your total borrowing capacity on your own at £112,500.

When you use a JBSP mortgage you can have up to 4 people on the mortgage. If for the sake of this example they also earn £25,000 a year, the total amount you can borrow overall is £450,000.

The average property price in the UK is £284,029. In London the average property price is significantly more at £521,146.

From the average property prices above, it is easy to see how a JBSP mortgage could be the difference between you achieving the affordability you need to buy a house or not.

JBSP Mortgages to Get a Buy to Let Mortgage and Lower Taxes

This only specifically works with couples and lowers a couple’s tax liability if you or your partner is a higher earner.

For example, if you’re currently in a higher tax bracket but your partner is a basic rate taxpayer, a standard Buy to Let mortgage would mean that you pay tax on a portion of the rental income at the higher rate.

But, with a JBSP mortgage you can assign the Buy to Let mortgage to the basic rate taxpayer and have the sole proprietorship in their name. This means any rental income is taxed on their tax bracket and not the higher rate.

Buy to Let properties have been increasingly targeted by the government and regulators over the last decade and the profitability of rental properties has been reduced for the majority of landlords who use a Buy to Let mortgage.

Paying tax at the higher rate as opposed to the basic rate can sometimes be the difference between a profitable Buy to Let venture and there being little or no profit margin.

JBSP Mortgages and Asset Protection

When you own a business in the UK, you often take on personal responsibilities that mean if the business suffers financially, you could lose personal assets.

To get financing in the UK a director can make personal guarantees to a lender to back that loan with collateral such as a property. Aside from guarantees against business financing, directors can find their personal assets are pursued by the courts in the event of business liabilities.

With a JBSP mortgage if you’re a business owner you can be an additional borrower and the property won’t be classed as your personal asset. This is because the sole proprietorship will be in someone else’s name.

What Our Clients Have To Say

Can My Partner Take a JBSP Mortgage to Avoid Stamp Duty?

There are two stamp duty liabilities that can come into play with JBSP mortgages.

Second Home Stamp Duty

If you’re a homeowner and don’t want to pay the second home stamp duty rate, then being an additional borrower on a JBSP mortgage will allow you to avoid the stamp duty.

This is because you won’t be registered as the owner of the property and therefore, you’ll have no second home stamp duty liability.

First Time Buyer Stamp Duty Discount

In the UK, first time buyers have advantages with stamp duty that aren’t afforded to people who’ve owned homes already. As a first-time buyer you’re not necessarily exempt from stamp duty altogether, but your liability will be reduced compared to other buyers.

If your partner is a first-time buyer but you have owned a property already, you can still get this benefit by listing them as the sole proprietor on the mortgage.

Again, this stamp duty is avoided because you won’t be the owner of the property and have no legal rights over the property.

JBSP Mortgages and Poor Credit History

If you have bad credit or no credit history, it can be difficult to find a lender that will allow you to borrow money.

What’s more, if you do manage to find a lender that will give you a mortgage, the interest rate typically offered will match the risks. In short, if your credit record is poor or non-existent, you’ll likely pay a higher interest rate.

With JBSP mortgages, you aren’t relying on just your credit profile alone and this can open doors to borrowing that would otherwise have been closed or expensive.

The additional borrowers will also be credit checked and if they have respectable scores, the lender is likely to think the risk is more balanced overall.

Pros of a JBSP Mortgage

This guide has covered the benefits of a JBSP mortgage in detail. To summarise:

- Greater affordability for those struggling to pass affordability checks.

- Pooling resources with other people to obtain a higher deposit and lower monthly costs.

- Stamp duty/tax benefits for additional borrowers not listed as the sole proprietor.

- Protection of assets for those not listed as sole proprietors.

- You might have recently changed jobs and find it hard to qualify for a mortgage alone.

- Allows you to get a mortgage with poor credit score/history at a more affordable cost.

Cons of a JBSP Mortgage

Whilst this article has touched on many of the benefits of a JBSP mortgage there are also some negative aspects you should consider.

- Sometimes affordability is hindered by additional borrowers, this is because they may have liabilities that eat into the affordability calculation. If the additional borrower has a poor credit score or history this can also cause complications.

- If the relationship between the borrowers breaks down, it can be very difficult for additional borrowers to remove themselves from the mortgage. This is especially the case where the sole proprietor hasn’t got the affordability on their own to afford the mortgage.

- JBSP mortgage applications are more intensive as there are multiple people that need to apply compared to one person.

- Additional borrowers take on a full mortgage liability with no ownership or legal right to the property. If the sole proprietor stops paying the mortgage a lender can chase additional borrowers for missed payments.

- A JBSP mortgage is a specialised product that isn’t currently widely available in the UK, you will likely need to enlist the help of a qualified mortgage broker to get a JBSP mortgage.

Conclusion

At Boon Brokers we know that getting a mortgage can be difficult. A JBSP mortgage can be a great option for some borrowers and there are also other mortgage products that might suit your circumstances better.

Boon Brokers is a UK whole of market mortgage, insurance and equity release broker and we can help you get the right mortgage for your situation. Better still we offer free, no obligation advice so call us to discuss your mortgage needs today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Getting A Joint Mortgage With Your Parents

- What Should I Ask When Buying A House?

- What Is A 100% Mortgage

- The Mortgage Underwriting Process

- Preparing For An Interest Rate Rise

- Purchasing A Property With Shared Ownership

- Everything You Need To Know About Buy To Let

- What Is A Deed Of Covenant?

- How To Get A Mortgage After Bankruptcy

- Benefits Of A Commercial Mortgage

- What Is A 5X Mortgage?

- Military Mortgages Guide

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757