How to Get an NHS Mortgage in 2024

Getting onto the property ladder is incredibly difficult for many people in the UK and it can be a frustrating experience for those who work in the NHS.

Many NHS workers have found that their income has stagnated over the last 10 years and with inflation rising NHS staff are finding the cost of living challenging to say the least.

With demands of work increasing and the compensation for doing the job often falling short of where it should be, you might find obtaining a mortgage quite a stressful experience.

Fortunately, you may qualify for a special discount or mortgage deal depending on the lender and your role in the NHS. But what exactly is this special mortgage deal and how do you qualify?

Our guide breaks down everything for you so you can get your dream home.

- What is an NHS mortgage?

- Who is eligible for the First Homes scheme?

- What restrictions are in place?

- What types of mortgage are available to NHS staff?

- Do NHS keyworkers receive discounts on mortgages?

- What determines how much NHS workers can borrow?

- Can I get a mortgage if I've just started working for the NHS?

- Speak to an expert mortgage adviser

What is an NHS mortgage?

There used to be an NHS mortgage scheme, but this has been discontinued and replaced with a first homes scheme that gives keyworkers a 30% discount.

It is important to mention that there is no such product as an NHS mortgage currently available on the market.

With that said, there are many mortgage products on the market that can help you if you work for the NHS and this article will highlight the type of mortgages available and how the first home scheme fits into your mortgage plans.

First Homes Scheme and Keyworkers

The scheme is designed to give those eligible a minimum 30% discount on the total price of a property.

Here are some of the features of the scheme at a glance:

- Applicants must meet the eligibility criteria (outlined below).

- Must be a first time buyer, and if you have been listed on Land Registry as an owner before this scheme is not available to you.

- After the 30% discount the property must be cheaper than £250,000 or in London £420,000.

- Available on any housing development that offers ‘First Homes’ and the house must be a ‘First Home’ on that development.

What Does First Homes Mean?

The UK government realised that many developers were creating new build developments and pricing first time buyers out of the market.

To combat this, they made it a requirement for developers to have at least 25% of any development properties as affordable housing, introducing the ‘First Homes’ definition in 2021.

First Homes must:

- Be discounted by at least 30%.

- Not exceed the value of £250,000 (or £420,000 for London properties).

- Only be sold to someone eligible for the first homes scheme.

The scheme and discount apply to the property and any subsequent sales made on the scheme. If a sale can’t be made on the scheme the property can be sold at market value.

The local authority will however collect the discounted amount from the market value sale, so any subsequent sale will need to be made with at least 30% of the purchase price added.

If a sale is made below the threshold to repay the local authority the discount, then it gets complicated and there are specific calculations that an authority must do to protect lenders from negative equity.

These calculations are designed to protect the lender and the local authority. You might sell and end up with nothing to show for the sale personally.

Who is eligible for the First Homes scheme?

To qualify for the first homes scheme, you need to be a first time buyer and also qualify for the stamp duty relief for first time buyers. That means if you have ever paid stamp duty in the past or owned a property you will not be able to use this scheme.

Eligibility also has income caps. You can’t exceed a household annual income of £80,000 (£90,000 in Greater London). This income cap is the same even if you’re a sole buyer or buying with your partner.

You will also need a mortgage or a home purchase plan that is at least 50% of the purchase price. This means that you can’t put down huge deposits on these properties and have small mortgages.

Lastly, local authorities also have the ability to impose further criteria at their discretion so if you’re looking to buy a first home you will need to check with the local authority to see if there are any additional requirements to qualify.

Free consultations are available in the UK.

Get Started NowWhat restrictions are in place?

There are standard restrictions when obtaining a mortgage that will apply to the first homes scheme.

In order to qualify for the mortgage, you’ll need:

- To have a deposit of at least 5% of the property value.

- To have demonstrable income that meets the lender’s affordability criteria.

There are also some specific restrictions relating to the first homes scheme.

As mentioned, you can’t:

- Put a deposit down of more than 50% of the discounted property value.

- Have owned a property or paid stamp duty before.

- Purchase a property not registered as a first home.

If you or your partner are a member of the armed forces some of the restrictions may be waived including local authority income requirements.

If you’re looking at this scheme from an armed forces perspective, you will need to discuss this with your broker who will be able to outline exactly what you need for the scheme.

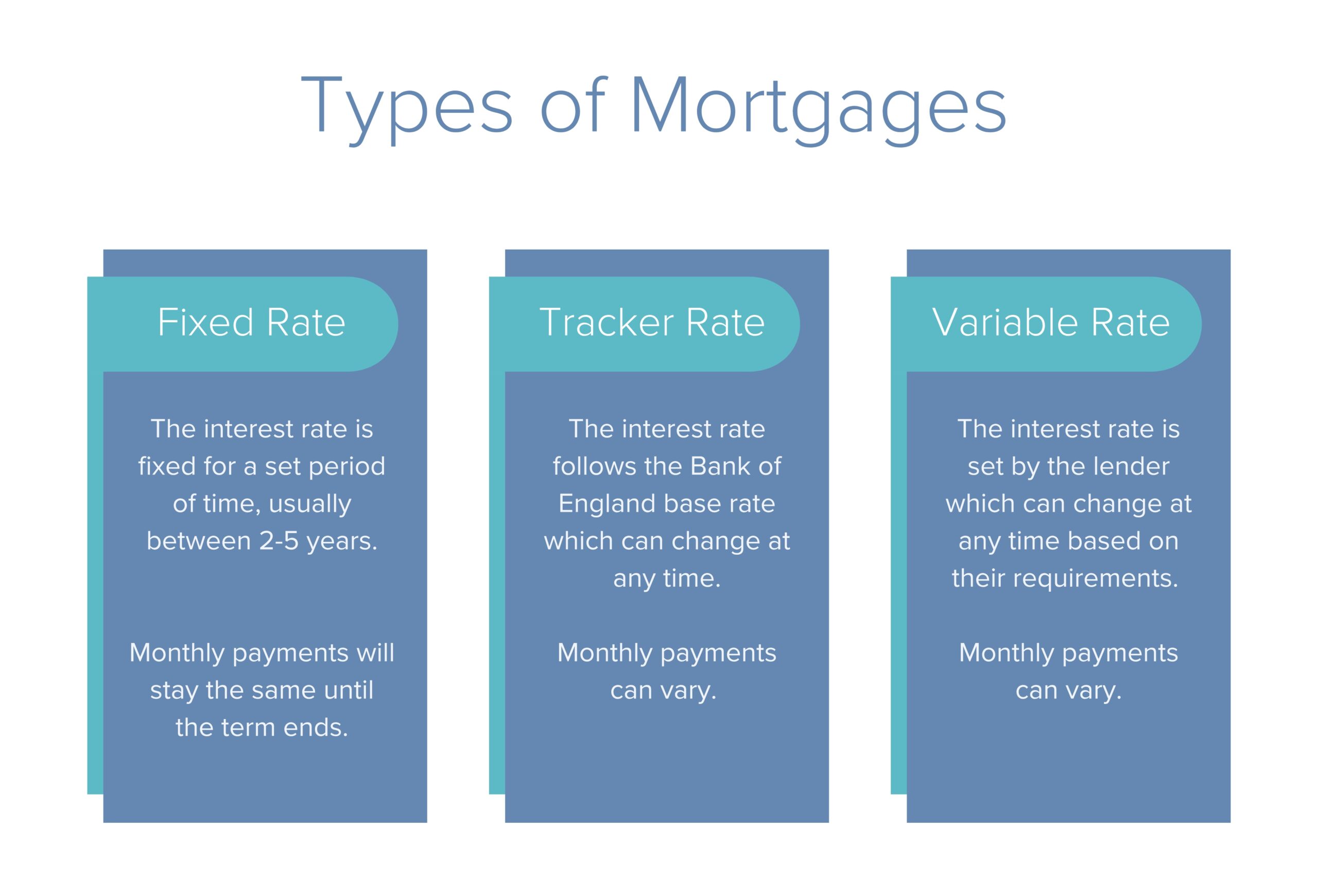

What type of mortgages are available to NHS staff?

The first homes scheme is a great initiative, and there are various mortgages that can be used in conjunction with this scheme.

Fixed Rate Mortgage

These are the most common mortgages that first time buyers use. A fixed rate mortgage will have a term (normally between 2 and 5 years) where the interest rate is fixed.

After the fixed rate term ends you can either remortgage onto another fixed rate product or your mortgage will revert to the lender’s standard variable rate.

Tracker Rate Mortgage

A tracker rate mortgage has a term (amount of time) attached to it like a fixed rate mortgage. Instead of the rate being fixed though, the lender charges interest that tracks the Bank of England Base Rate. Normally the interest payment is a little over the base rate.

Historically these were excellent mortgages as the Base Rate has been consistently low for many years, however with rates increasing it is best to discuss this type of mortgage with your broker to see if it is right for you at this point in time.

Variable Rate Mortgage

A few lenders offer variable rate mortgages that don’t have a set rate of interest. The variable rate can change according to how much risk the lender feels the loan represents.

These mortgages are rare if you’re initially getting a mortgage as most providers offer fixed or tracker rate deals to new borrowers.

When your fixed term ends you will be placed onto the lender’s standard variable rate which works in the same way as a variable rate mortgage.

When you get your mortgage information, the documents will outline the current standard variable rate of the lender so you can get an idea of what to budget when your fixed rate ends.

Remortgaging is an option to avoid being on a variable rate mortgage and many opt to do this because variable rates tend to be uncompetitive and expensive compared to other mortgage deals.

What Our Clients Have To Say

Do NHS keyworkers receive discounts on mortgages?

Under the first homes scheme, keyworkers will be entitled to the same 30% discount on first home properties.

Part of the reason the first homes scheme was introduced was to broaden the range of options available to all buyers and not NHS staff exclusively.

What determines how much NHS workers can borrow?

There are two things to consider when applying for a first homes scheme mortgage.

You need a deposit that is not greater than 50% of the property value. The deposit can come from savings, investments or be gifted by family members.

When you have your mortgage deposit, you need to show where it has come from. For example, you might provide the lender with bank statements from your savings account showing your contributions.

Once you have your deposit out of the way, each lender will require you to pass affordability for the mortgage. The first homes scheme has been designed to help those on low incomes get onto the property ladder, but it isn’t a sure-fire way of getting a mortgage.

Typically, lenders will allow you to borrow 4.5 times your annual salary, although some lenders offer more generous affordability. To make sure you’re approaching a lender that will accept your income against the property you should use a mortgage broker.

At Boon Brokers we are a whole of market UK mortgage, insurance and equity release broker. We have access to some lenders that allow you to borrow up to 5 times your annual salary. So, if you’re struggling with affordability, it is worth discussing your income with us and we will try to help.

You can also use our mortgage calculator to get a rough idea of how much you can borrow.

Like with your deposit, you will need to provide evidence of your income which is normally in the form of payslips for NHS staff and keyworkers.

Affordability and the First Homes Scheme

As discussed earlier there are income caps on the first homes scheme.

With a traditional mortgage, income caps would not work well for affordability purposes because a lender will want you to demonstrate a level of income that means you can afford the mortgage.

As these two things seem counter-intuitive the government has put in a rule to the scheme that stipulates any local authority cap can’t prohibit someone from getting a 95% loan to value mortgage.

In short, the income cap can’t be so restrictive that it prevents you borrowing 95% of the discounted property value with a 5% deposit.

Because local authorities aren’t in the mortgage industry themselves, if you encounter a problem with your affordability on your preferred lender as a result of an income cap you should raise this with the local authority.

As a result of the government guidelines, the local authority must then reassess their income cap.

Whilst not a perfect system, it is one that you can appeal against and is backed by the government rules.

Can I get a mortgage if I’ve just started working for the NHS?

Absolutely, you can get a mortgage even if you’ve just started your NHS job. Most lenders usually ask for some kind of employment proof like an employment contract or payslips. If you’ve got a job offer but haven’t officially started, your lender might assess your situation based on the details in your job contract.

If you’re in this situation, it’s a great idea to chat with a mortgage adviser like Boon Brokers to explore your options. Having all the important documents ready, like your employment letter and start date, can really help to make this a smooth process.

Speak to an expert mortgage adviser

Historically NHS mortgages have been helpful for NHS staff such as GPs, nurses and doctors to obtain a specialised mortgage. But, after the COVID-19 pandemic the government realised that these products were restrictive and didn’t help workers who are just as important for public health like keyworkers.

The first homes scheme is designed to give a broader product for those on lower incomes and could be a great scheme for you to use.

You should discuss your goals and financial circumstances with a qualified mortgage broker before deciding your course of action.

Boon Brokers can advise on government schemes and help you get the mortgage that is right for your situation.

We offer FREE, no obligation advice so get in touch with us to discuss your mortgage today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- How To Buy A House After Lockdown

- How Much Deposit Do I Need For A Mortgage

- What Is A Mortgage In Principle?

- What Should I Ask When Buying A House?

- How Long Does A Mortgage Application Take?

- What Is An Offset Mortgage?

- What Is A Key Facts Illustration?

- What Is A Tenants In Common Agreement?

- Reasons To Review Your Mortgage Regularly

- Why Buy A Home In Norwich?

- Reduce Mortgage Term Or Overpay

- Choosing A Mortgage Broker

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757