What Is CheckMyFile?

In today’s world, financial health is of paramount importance. Whether you are applying for a mortgage, a credit card or even a job, your credit history plays a pivotal role in determining your eligibility and interest rates. One valuable tool that can help you gain insight into your credit profile is Checkmyfile. In this article, we explain what Checkmyfile is, how it works and why it matters.

- What is Checkmyfile?

- How Does Checkmyfile Work?

- Is Checkmyfile Worth It?

- How Do I Cancel My Subscription On Checkmyfile?

- How Often Does Checkmyfile Update?

- What Information Do Credit Reference Agencies Check?

- What is a Good Credit Score on Checkmyfile?

- Contact a Mortgage Broker About Your Checkmyfile Report

What is CheckMyFile?

CheckMyFile is a service that collects information across multiple credit reference agencies and provides an aggregate credit score. In the UK, there are three main credit reference agencies: Equifax, Experian and TransUnion. Each of these agencies collects and maintains credit information about individuals, including their borrowing and repayment history, personal details and public records.

How Does Checkmyfile Work?

Checkmyfile is an online credit reporting service that provides individuals with a comprehensive view of their credit history and financial profile. The way it works is simple yet powerful.

Users sign up for an account and Checkmyfile gathers credit data from all the three major credit reference agencies. It then compiles this information into a single, easy-to-read credit report. This unique multi-agency approach allows users to see your credit information from multiple sources, giving you a more complete and accurate picture of your financial standing.

Free consultations are available in the UK.

Get Started NowIs Checkmyfile Worth It?

Checkmyfile allows you to access data that lenders consider when evaluating your mortgage application. You can track how your credit score changes and spot errors that could negatively affect your credit.

If your credit report reveals areas of concern, Checkmyfile can help you identify these issues and work on improving your credit score over time. This is especially valuable if you plan to apply for loans or credit in the future.

They currently offer a free trial period of 30 days, but require you to supply your card details. You will not be charged anything until the 30 day trial period ends and then your monthly subscription of £14.99 begins.

You can, however, cancel at any time meaning you could generate a one-off report then cancel before the subscription starts. Your account can always be reactivated in the future.

How Do I Cancel My Subscription On Checkmyfile?

You can cancel your subscription at any time by calling 0800 086 9360 between 9am and 5pm Monday to Friday or follow the following steps:

- Log into your Checkmyfile account and click on ‘Expert Help’

- Click ‘I need help with my account’

- Select ‘I’d like to stop my subscription’

What Our Clients Have To Say

How Often Does Checkmyfile Update?

Typically, credit reference agencies update their records on a monthly basis, but some can be quicker than others. This means you could have paid off your credit card yesterday, but your credit report does not reflect that. Credit scores are dynamic and can change over time as circumstances and finances change.

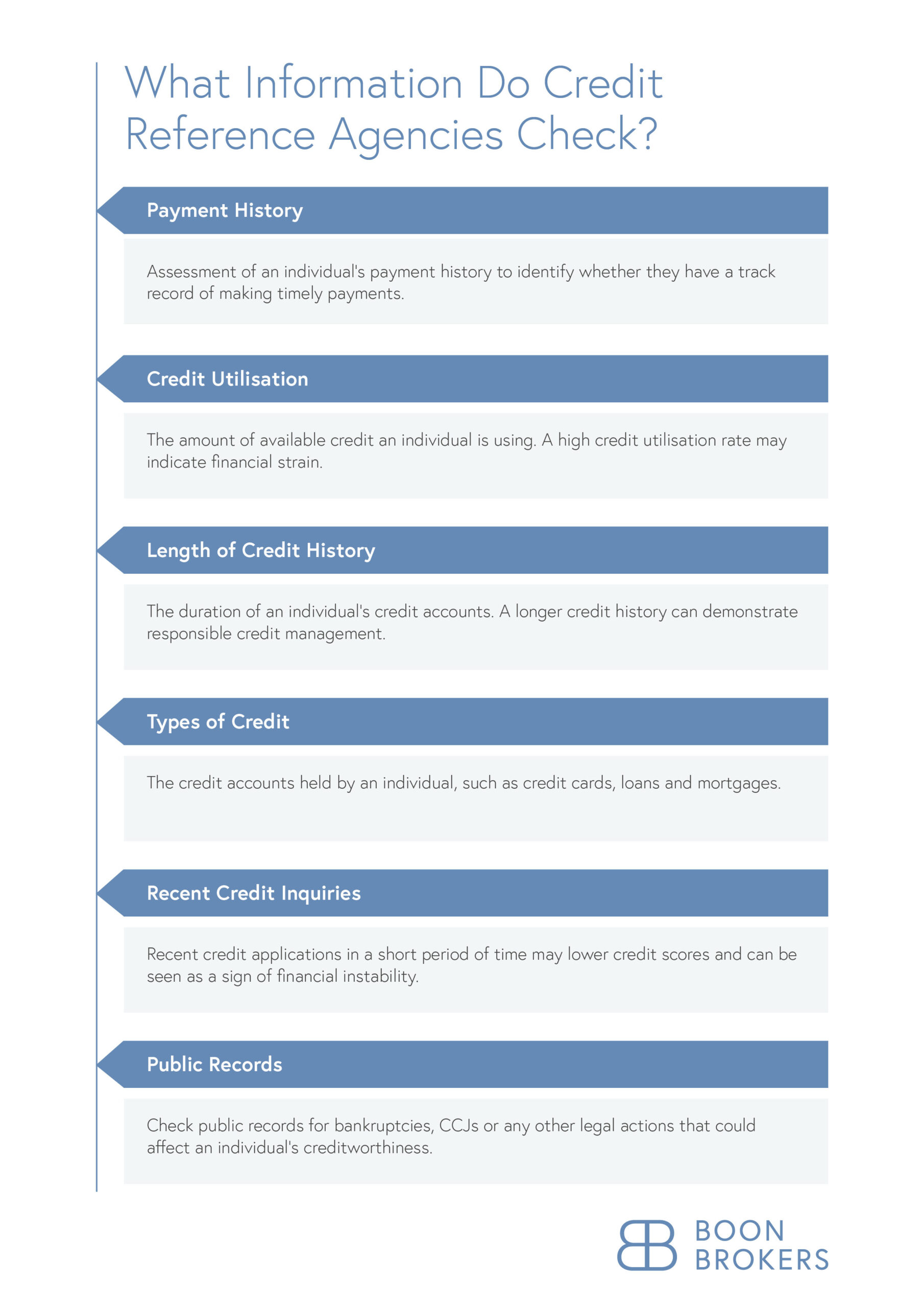

What Information Do Credit Reference Agencies Check?

Credit reference agencies collect and analyse a range of financial data to compile comprehensive credit reports and calculate credit scores. Here is a breakdown of the key information they check when evaluating an individual’s credit profile:

Payment History

Credit reference agencies will assess an individual’s payment history to identify whether they have a track record of making timely payments on credit accounts and bills. Consistent on-time payments contribute positively to a person’s credit score.

Credit Utilisation

The amount of available credit a person is using will be analysed by credit reference agencies. A high credit utilisation rate may indicate financial strain and can negatively affect credit scores.

Length of Credit History

The duration of an individual’s credit accounts is taken into consideration. A longer credit history can demonstrate responsible credit management.

Types of Credit

Credit reference agencies will evaluate all the credit accounts held by an individual, such as credit cards, loans and mortgages. A diverse credit mix can positively impact credit scores.

Recent Credit Inquiries

Recent applications for credit are noted and multiple inquiries in a short period of time may lower credit scores, as they can be seen as a sign of financial instability.

Public Records

Credit reference agencies also check for public records, including bankruptcies, County Court Judgments (CCJs) and other legal actions that may adversely affect an individual’s creditworthiness.

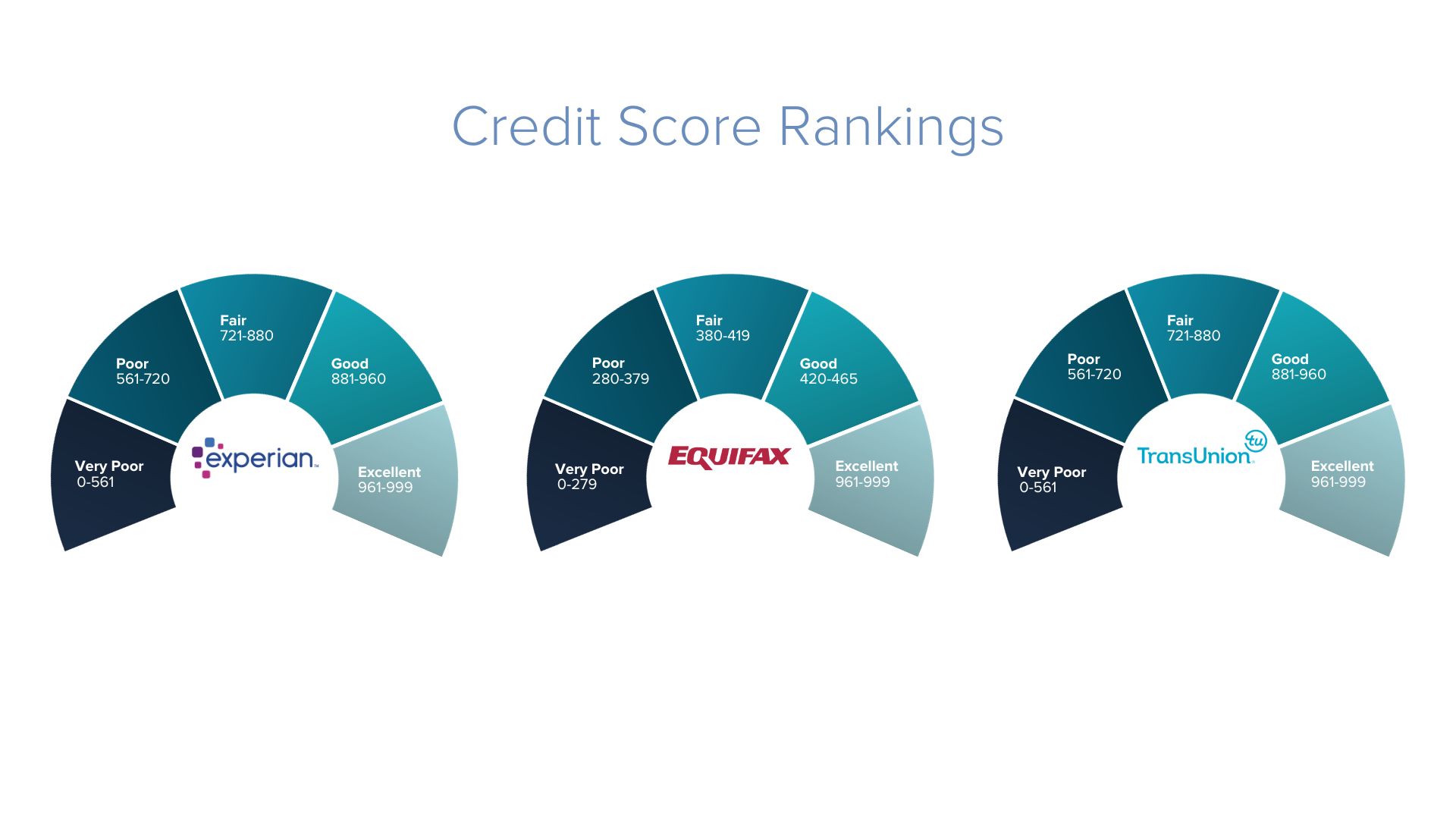

What is a Good Credit Score on Checkmyfile?

Credit scores typically range from 0 to 999 and what constitutes a “good” credit score can vary depending on the lender and the specific credit scoring model used. However, as a general guide, a credit score above 700 is often considered good and may make it easier to qualify for loans and credit cards with favourable terms. Scores above 800 are usually seen as excellent and can open doors to the best interest rates and credit offers.

It is essential to keep in mind that different lenders may have different criteria and a good credit score alone does not guarantee credit approval. Lenders also consider other factors like income and employment status when making lending decisions.

It is essential to keep in mind that different lenders may have different criteria and a good credit score alone does not guarantee credit approval. Lenders also consider other factors like income and employment status when making lending decisions.

Contact a Mortgage Broker About Your Checkmyfile Report

Using a credit check service like CheckMyFile can be invaluable, especially if you are looking to get a mortgage. If you are looking to get a mortgage but worried or confused by your credit score, Boon Brokers is a UK whole of market mortgage, insurance and equity release broker. We have access to lenders that will even consider poor credit scores for mortgages.

Contact Boon Brokers today to discuss your credit score and get FREE, no obligation mortgage advice.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757