Extending Your Mortgage for Cosmetic Surgery? Our 2024 Survey

Many homeowners across the UK will consider extending their mortgage at some point in their life. With the cost of living rising and goods and services becoming more expensive, it can be difficult to pay for the things we want.

Over the years, homeowners have sought to release equity or extend their mortgages with a view to buying all sorts of things – from a new car to that dream holiday. But what about cosmetic surgery?

Can you really extend your mortgage to cover the cost of liposuction? Our surprising survey highlights some of the things homeowners are willing to extend their mortgage for.

The Boon Brokers Mortgage Extension Survey

As part of our ongoing commitment to our customers we thought it was high time we found out the reasons for extending mortgages.

We commissioned a survey to do just that so that we can understand our clients demands and needs when applying for mortgage extensions.

The survey was simple, we asked 2,100 UK homeowners if they would extend their mortgage and what the reasons would be for doing so.

We also threw in a curveball question out of curiosity and asked whether they would lie to their mortgage lender about their reasons to get the desired funds.

The Mortgage Survey Results

As you might imagine, the results were varied and it became immediately clear that people across the UK have a range of reasons why they would look to extend their mortgages.

Below we have outlined the top 10 reasons.

The Top 10 Reasons for Extending a Mortgage

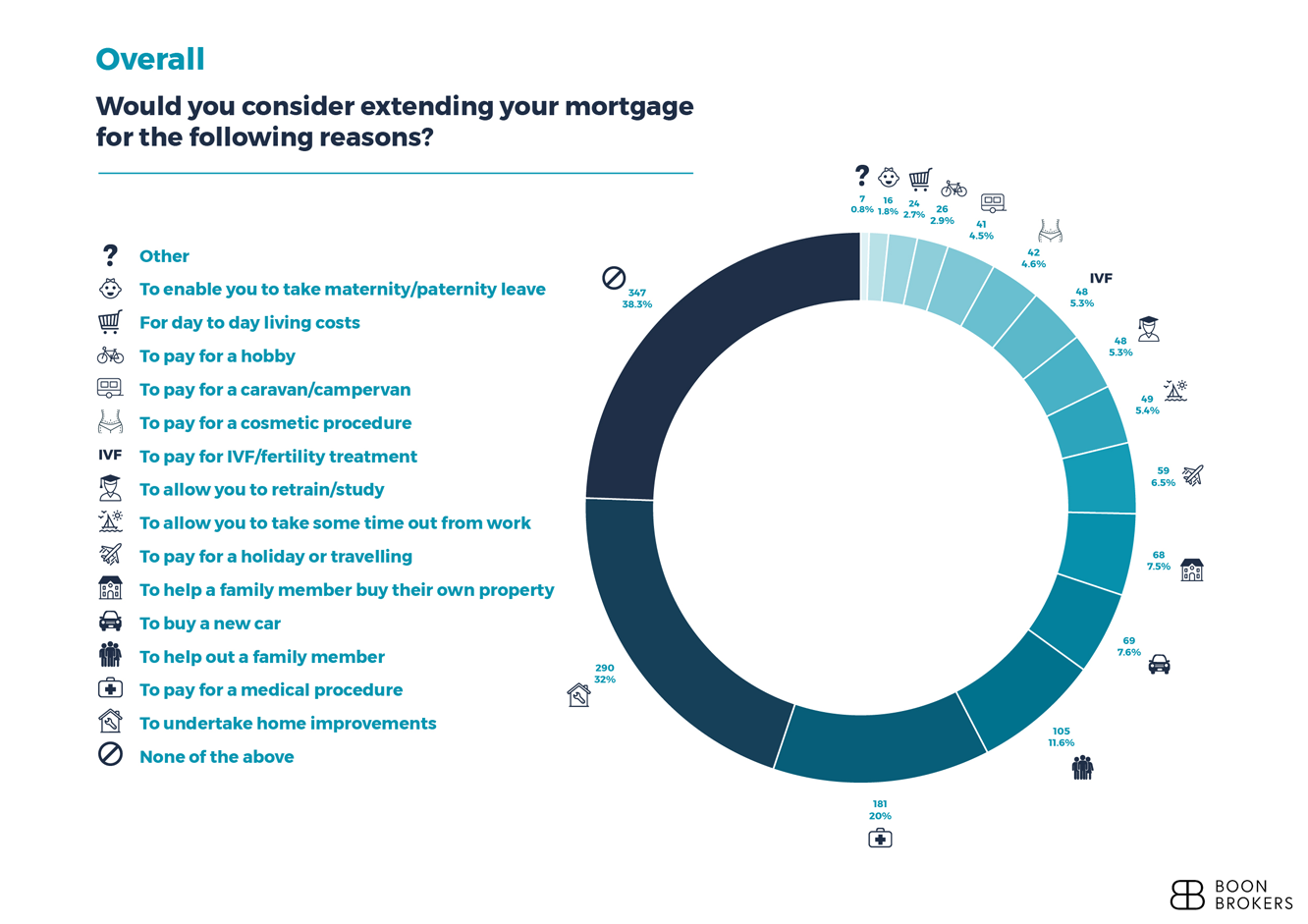

According to a Boon Brokers survey, the most common reasons for extending a mortgage are:

Home Improvements (32%) By far the most common reason that people wanted to extend their mortgage was home improvements.

This encompassed works like remodelling, redecorating and extensions.

Home improvements can be a really prudent reason to extend a mortgage as renovations or extensions can add value to a property.

A Medical Procedure (20%) This one took us by surprise as it is well known that most medical procedures are available free of charge on the NHS.

The respondents outlined surgeries not available on the NHS or a desire to go private and cut wait times for important medical procedures.

According to a recent YouGov poll, 17% of people in the UK would opt to go private rather than wait on an NHS waitlist.

The Guardian reports that there has been a large boom in private healthcare in recent years with people losing faith in the NHS.

To Help Family Members Financially (12%) It is no secret that the current economic climate is difficult to say the least. Many families across the UK are struggling and we all know someone that was financially hit by the pandemic.

Perhaps the most admirable result on our list, 12% of those surveyed said they would extend their mortgage to give the money to a family member who needed it.

To Buy a New Car (8%) In times past this reason would have probably featured higher in our list, but the financial market has changed and today it is fairly straightforward to arrange all manner of finance solutions for buying a car.

With that said, some of the homeowners surveyed would prefer to extend their mortgage rather than source finance elsewhere to buy a car.

To Help a Family Member Buy a House (8%) In joint fourth place, homeowners would look to extend their mortgage to help a loved one buy a house.

At Boon Brokers we are aware that deposits can be the single largest barrier to entry and by extending a mortgage, a homeowner can gift the money to a family member.

This isn’t without risk though as normally when a deposit is gifted you would need to waive your right to repayment regardless of if you owe the money to your lender.

To Pay for a Holiday (7%) If you’re considering taking that holiday of a lifetime then you’re not alone. 7% of the respondents in our survey indicated they would extend their mortgage to pay for a holiday.

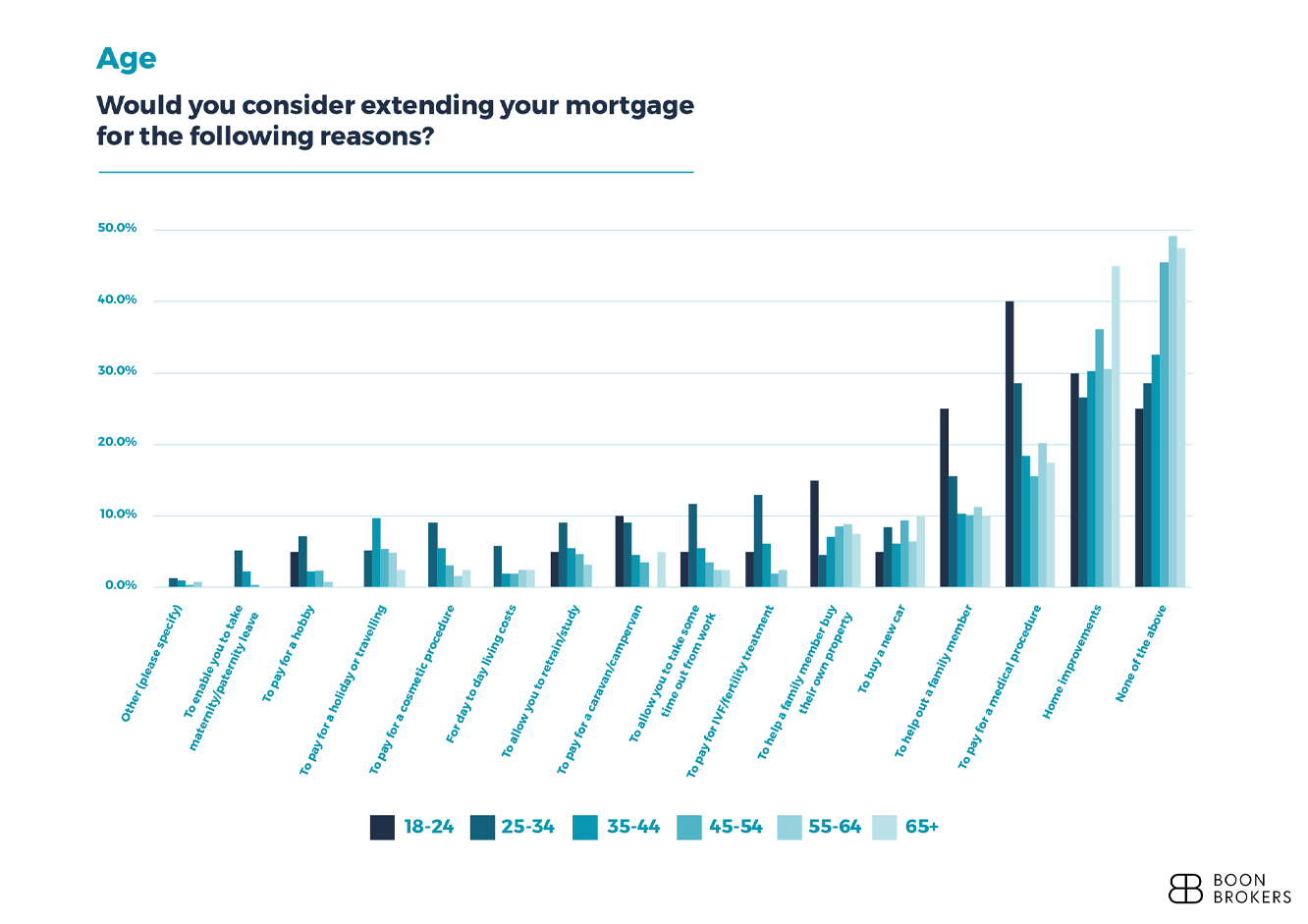

To Retrain/Study/Personal Improvement (5%) We live in a fast-paced and dynamic world where job skills of yesterday are becoming obsolete and new skills are needed in the job market.

Older homeowners with skills that could be lost to automation are particularly vulnerable.

It is little wonder then that 5% of respondents would extend their mortgage to retrain or study so that they can secure financial stability in the future.

To Fund IVF/Fertility Treatments (5%) According to the NHS, as many as 1 in 7 couples may have difficulties conceiving and sometimes the only option is to rely on fertility treatment.

Some fertility treatments can be extremely expensive and for homeowners looking to start a family, it’s a completely understandable reason to wish to extend a mortgage.

To Fund Cosmetic Surgery (5%) This one took us by complete surprise, and we weren’t expecting it to feature at all on our list.

Cosmetic procedures in the UK are varied and people can sometimes suffer terribly with self-image making them an invaluable lifeline to those struggling with their mental health.

We will explore this in a bit more detail further down!

To Buy a Campervan/Caravan/Motorhome (5%) Travelling around in your own accommodation has been popular in the UK for decades now.

It allows you to visit places with many of the home comforts you might not find in a hotel or on a campsite.

The market to finance motorhomes and caravans is not as large as the car financing market, meaning that many find extending their mortgage a great alternative to other means of borrowing.

Free consultations are available in the UK.

Get Started NowData Breakdown

We’ve also prepared some infographics showcasing the data below, with three infographics having data filtered by city, gender and age.

Overall Data

Broken down by Age

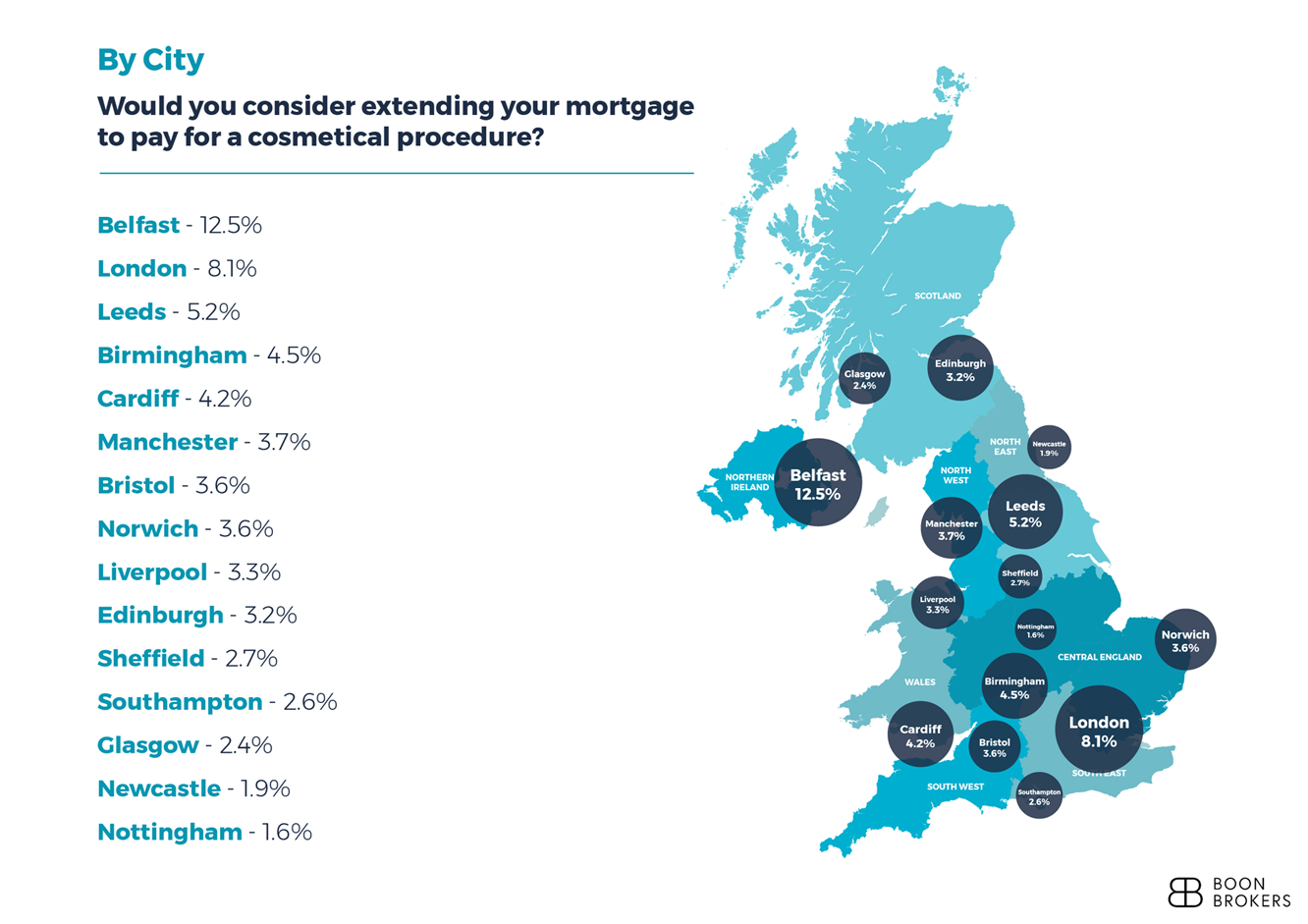

Broken down by City

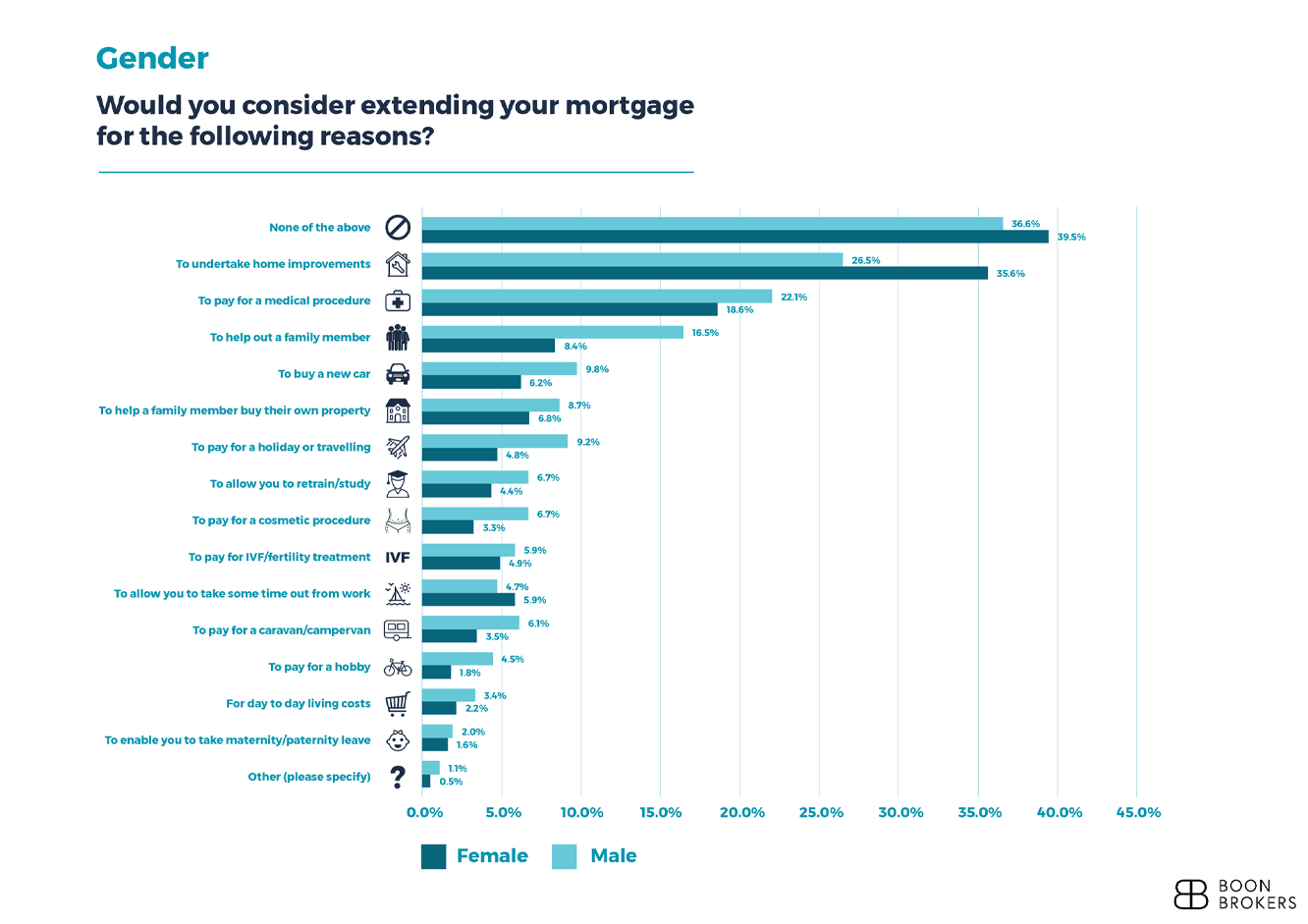

Broken down by Gender

A Closer Look at Cosmetic Surgery in Our Survey

You might be wondering why someone would extend their mortgage for cosmetic surgery or what type of person would be inclined to do so.

As part of our survey, we looked at the gender of respondents and you might be equally surprised that more men (7%) wanted to extend their mortgage than women (3%) for the purpose of cosmetic surgery.

This might not actually be a reflection of the demand for cosmetic surgery between genders though as the survey also highlighted men were twice as likely to want to extend their mortgage for personal hobbies than women.

In this respect, it might mean that men aren’t more inclined to get cosmetic surgery than women, but they’re a bit more irresponsible with their reasons for wanting to extend their mortgage.

Or they could just want to spend money on cosmetic surgery more than women who knows!

A more detailed analysis would need to be done to ascertain the reasons why those surveyed answered in the way they did but we find it fascinating, nonetheless.

What Our Clients Have To Say

Extending Your Mortgage

There are a couple of ways you can extend your mortgage and which you choose will depend on your current circumstances and situation.

Approaching Your Existing Lender

This is perhaps the easiest way for you to extend your mortgage as your existing lender will have already underwritten the mortgage and will have your information on record.

The downside to approaching your existing lender is you might not be getting the best deal that is available to you and extending your mortgage in this way might cost much more than if you remortgaged with another lender.

Remortgaging With Another Lender

If you use a whole of UK market broker like Boon Brokers, you will be able to access a range of deals and compare which one suits you most. What’s more, all of our advice is free so you can remortgage onto a better deal without needing to pay mortgage broker fees.

Risks of Extending Your Mortgage

Whenever you remortgage or extend your mortgage your lender will conduct an affordability check and also look at the amount of equity you hold.

Low Equity

If you have low equity, especially if it is 5% of less of the property’s value, then a lender will probably decline to lend further on the property as they will want to protect customers from being at risk of negative equity.

Early Repayment Charges

If you’re currently locked into your mortgage deal, perhaps from a fixed interest rate, your existing lender may have an early repayment charge in place.

These can be substantial amounts of money that would eat into any amount you would look to borrow.

If you’re currently tied into a mortgage deal, then it is best to find out what early repayment charges you have and discuss the additional lending with your broker.

For example, you might be tied into a fixed rate for a further 2 years which has a fee attached to it if you want to exit the deal early. If this fee is £10,000 and you’re looking to borrow £15,000 then it’s probably best to wait until the mortgage deal ends before you remortgage.

Non-Essential Reasons for Extending a Mortgage

Lenders are keen to lend money in circumstances where you can afford the loan and the purpose of the loan improves your overall financial standing.

For example, if you want to borrow £20,000 for a loft conversion that will potentially add £40,000 of value to a property, a lender is more likely to consider this as a good loan compared to cosmetic surgery.

That is because certain reasons are considered non-essential and have no financial gain for borrowers.

In a lender’s eyes something like cosmetic surgery would be seen as what’s known as a sunk cost in other words the borrower is never going to see a return on that investment.

That doesn’t mean lenders won’t consider such lends, just that they’re more likely to decline lending on that basis.

Market Risks

Currently in the UK the cost of living is rising exponentially, and interest rates are rising as a result.

With costs soaring the mainstream media have been quick to deem the current economic outlook as a crisis.

Whether a crisis or not, the current uncertainty around the cost of essentials like energy and food is without doubt worrying and you should consider whether a mortgage extension is sensible at this time.

You will need to factor in your personal disposable income and how much of that would be eaten away by any further price rises that currently seem inevitable.

Your broker will look at your overall financial situation and can advise you about any risks specific to your circumstances.

Survey Indicates Homeowners Are Willing to Lie on Applications

The most alarming finding from our Boon Brokers survey was that 7% of respondents said they would be willing to lie or deceive their lender in order to secure further borrowing.

Whilst we didn’t probe into the details of this, we assume it meant a borrower might say they are looking to extend their mortgage for renovations but really intend to spend the money on something like cosmetic surgery.

Lying to a lender is not only unethical, but it is also illegal. When you make any type of mortgage application you sign to verify all of the information you provide is accurate and honest.

If at a later date this transpires not to be the case and that you have deliberately misled a lender, you will have committed mortgage fraud.

The penalties for mortgage fraud in the UK are severe with the offence carrying a sentence of up to 10 years in prison.

You DON’T Need to Lie to Extend Your Mortgage

The UK mortgage market is varied, and every lender has a different appetite to risk. That means you don’t need to lie in order to obtain a mortgage, you just need to find the right lender for your needs and circumstances.

While it is certainly true that some lenders will be reluctant to lend to some borrowers, others are much more flexible and at Boon Brokers we have obtained mortgages for people in very unusual and surprising situations.

We offer FREE, impartial, no obligation advice. Contact Boon Brokers now to discuss extending your mortgage even if it’s for something non-essential.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Reasons Why Mortgage Applications Are Declined

- The House Buying Process

- Benefits Of A Commercial Mortgage

- Preparing For An Interest Rate Rise

- How Does Being Self Employed Affect A Joint Mortgage?

- How To Get A Mortgage With Bad Credit

- What Documents Are Needed For A Mortgage?

- What Proof Of Income Is Needed For A Mortgage?

- How Long Does A Mortgage Application Take?

- How To Get A Mortgage With A New Job

- How Much Deposit For A Mortgage?

- Should I Use My Estate Agents Mortgage Broker?

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757