How To Choose a Mortgage Broker: The Essential 2024 Guide

There are many reasons to use a mortgage broker, from saving money to finding the right mortgage deal for you.

In this guide, we take a look at the different services mortgage brokers provide, as well as the of benefits of working with a broker.

Short for time? Here’s a quick video overview of what to take into account when choosing a mortgage broker.

- What is a mortgage broker?

- Why use a mortgage broker?

- Risks of getting no advice

- What types of mortgage brokers are there?

- Mortgage broker fees and commissions

- Key questions to ask a mortgage broker

- How to choose a mortgage broker?

- Your rights when using a mortgage broker

- What to look for in a mortgage deal

- Speak to a mortgage broker

- Jargon Buster

What is a mortgage broker?

A mortgage broker will help you find the right type of mortgage lender based on your financial circumstance. The broker may charge a fee to the applicant or to the lender, or both to pay for their role in the mortgage arrangement process.

In return for that fee, the broker will provide the mortgage applicant with expert advice. This can be particularly useful if the applicant has special circumstances that require specific advice, such as adverse credit, that a standard lender would be not be able to provide.

A mortgage broker will usually be able to access a wider selection of mortgage deals than you would be able to find online yourself.

Mortgage brokers have in-depth knowledge of the mortgage market, meaning that they can quickly identify suitable deals and save the applicant a great deal of time researching and speaking to different lenders.

Why use a mortgage broker?

One of the key reasons for using a mortgage broker is their expert knowledge to find the most suitable mortgage deal for you. The difference between taking out one mortgage deal compared to another can be enormous in terms of overall costs.

Brokers regularly work with a range of lenders and get to understand the preferences and criteria of each one. They factor in every detail when carrying out a search, including credit report, loan amount, LTV (Loan-to-Value), income, employment and any other information that lenders use. They also have software that enables them to quickly find deals that match the borrower’s criteria, which is much quicker than carrying out your own search.

Mortgage borrowers who have special circumstances, for example adverse credit, often choose to use a mortgage broker to find a lender that will be suitable for their situation. Instead of approaching standard lenders and having an application declined, the specialist broker will know exactly which lenders will be able to provide a mortgage. A declined mortgage application can affect the applicant’s credit report, so using a broker that finds the right mortgage lender will avoid this.

Other circumstances where an applicant might choose a specialist mortgage broker is when they are self-employed and providing payslips to prove income is not an option. There are numerous lenders that specialise in providing mortgage loans to self-employed workers and brokers can connect you with them.

A mortgage broker can also help to speed up the process. They can reduce tasks like paperwork and speaking to different lenders and solicitors, which can be very time-consuming. If a mortgage takes too long to go through, you could potentially lose out on buying the property.

All mortgage brokers should be regulated by the FCA. This protects the borrower as they can escalate complaints if anything goes wrong. When looking for a broker, you can check whether they are authorised by the FCA to ensure you are protected.

Free phone and video consultations are provided in the U.K.

Get StartedRisks of getting no advice

Mortgages are complex and there are many different factors that influence the type of deal that is best for you. Without the advice of a mortgage broker, you are at risk of paying more for a mortgage than you need to. You could end up paying a higher interest rate or get tied into a deal with a high early repayment charge.

If you choose not to work with a broker you will also not be able to complain that they have provided you with an unsuitable mortgage as they will not be authorised by the FCA.

See What Our Clients Have To Say

What types of mortgage brokers are there?

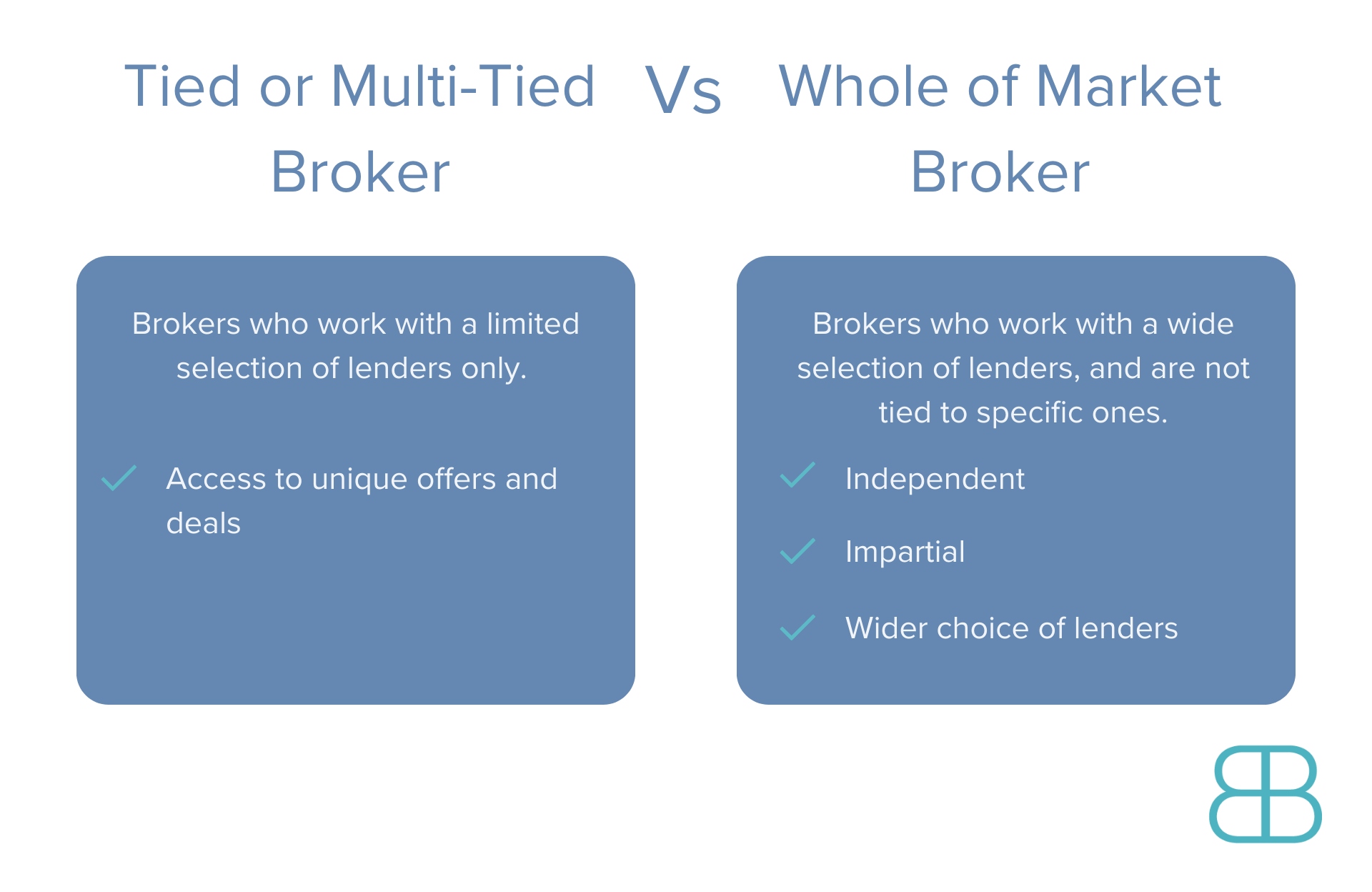

There are two main types of broker, some are tied to one or a few specific lenders and others are whole-of-market brokers. There are some brokers that say they are whole-of-market, but they won’t check the deals that are direct only. It is important to find out which lenders the mortgage brokers check on your behalf.

Mortgage broker fees and commissions

Mortgage brokers may charge you a fee for their services, or they may just apply a fee to the lender.

The average mortgage broker fee will be around £500 but different brokers work in different ways, some will apply a fixed fee, others charge for their time at an hourly rate. There are also brokers that charge based on a percentage of your mortgage and charge both the lender and borrower.

The mortgage broker must be clear about their fees under the requirements of the FCA and borrowers must be aware of unethical mortgage brokers that are not clear about their fees.

Brokers such as Boon Brokers do not charge you a fee at any stage. We receive commission from the lender instead.

Key questions to ask a mortgage broker

When choosing a mortgage broker, there are some key questions to ask that will help you determine whether they will suit your needs. These questions include:

Are you whole-of-market?

If your mortgage broker is whole-of-market, they will have access to all of the available mortgage deals on the market, so they are more likely to find you the best deal.

Will you tell me about mortgages that are only available directly from lenders?

If you don’t ask them this question, then they probably won’t tell you whether or not they check the deals that are directly from lenders.

So, make sure you ask this question, as you could be missing out on deals that are only offered direct from the lender.

What are your fees and charges?

Mortgage brokers operate differently when it comes to their fees. They should tell you exactly what they charge, whether it is a flat fee, a percentage of your mortgage or if they charge commission to the lender.

You should be able to find a good, reputable mortgage broker that will not charge you any fees for their service, as they will get paid by the lender instead.

What is included in the service you offer? Will you handle all admin and chase lenders?

One of the main advantages of using a broker is that they will do all the hard work, including all the admin elements and chase the lenders on your behalf. When deciding which broker to work with, clarify what services they offer and see how much work they are prepared to do for you. Some mortgage brokers offer the minimum, but others will do as much as they can.

When will you be available?

This is another critical question, especially if you want to get your mortgage in place relatively soon. Don’t assume that the broker will be able to start working on your mortgage search straight away. They could have a lot of other clients they are currently working for and you could be waiting some time to get started.

How to choose a mortgage broker?

The main factors that you should consider are whether they are a whole-of-market broker like Boon Brokers, whether they charge any fees and what sort of reputation and experience they have.

Some mortgage brokers operate with a web-based service only, so you should also decide whether you are happy to work on that basis, or if you prefer being able to talk to someone face-to-face about your mortgage details.

A good way to see whether a broker provides good service is to check any customer reviews that have been provided.

Brokers will probably have testimonials on their websites from happy customers, but this does not give the full picture, as they will cherry-pick the best testimonials to upload onto their website.

Finding reviews on sites like Google will give you a more accurate and unbiased set of reviews that may reveal what the brokers are like to work with.

You should also check what qualifications a mortgage adviser has. In the UK, the qualification approved by the FCA is the Certificate in Mortgage Advice and Practice (CeMAP). All brokers should also be authorised by the FCA, so you can check that they are by searching on the Financial Services Register.

Your rights when using a mortgage broker

When you work with a mortgage broker, they should complete a detailed review of your circumstances to establish the best deals for your situation. Your broker should be able to advise you on the pros and cons of taking on different types of mortgage and advise which one you are better suited to.

Their recommendations should be fully justified with a breakdown of the finances of the deal and they should explain why the deal is a better option for your circumstances.

There is a lot of jargon in the financial industry, so if you are not sure what LTV ratio is or why it matters, your mortgage broker should be able to help you to understand this.

We have also included a jargon buster section at the end of this guide to help understand some of the terminology.

What to look for in a mortgage deal

- APRC

The Annual Percentage Rate of Charge shows you the total cost of a mortgage based over the full term, including all associated fees. By providing you with the APRC for different mortgages, you can see the financial difference from one lender to another over the period of time you choose to take the mortgage over.

- Deposit size

The higher your deposit amount, the better mortgage deals you will have access to. The Loan to Value ratio (how much your mortgage loan is compared to the value of the property) is really significant in accessing different types of deals. Some are available for 80% LTV, whilst others are for 70% LTV, etc.

- The standard rate

If you are choosing a fixed rate for a number of years, it is important to look at what the standard rate of the deal is when the fixed term comes to an end. Whilst you will usually be in the position to switch mortgage deals at the end of your fixed-rate, you don’t know what will happen to the mortgage market. It is best to choose a deal with a competitive standard rate if available to you.

- How often is interest charged

Most lenders charge interest on a monthly basis, calculating the average monthly payment over the term so that all monthly payments are the same. Other mortgages might charge a daily interest, meaning the monthly payments vary depending on the number of days in the month.

- Flexibility

If your circumstances change, having flexibility around your mortgage payments can be really important.

You may want to take a break from making payments if you need to, or you may want to overpay so that you can pay your mortgage off quicker and reduce the overall interest. Check for any penalties or limits that the lender applies if you want to overpay on your mortgage.

You should also check any early repayment charges that apply, to make sure that you don’t end up staying locked into a mortgage deal for longer than you need to be.

- Length of fixed or variable rate deal

Deciding on the length of the fixed rate can be a difficult decision, as it is difficult to predict how the interest rates will be affected over a three or five-year period.

Some people prefer to lock themselves into a fixed rate for a long period so that they know exactly what their payments will be for that term.

However, if circumstances changed, for example you needed to move house, you might be subject to an early repayment charge to get out of the fixed term they agreed.

Your mortgage broker will be able to talk through possible scenarios to identify more flexible deals if it is likely that you will need flexibility.

Speak to a mortgage broker

There are so many reasons for using a mortgage broker when buying a home. Purchasing a house is a significant investment and mortgage deals vary greatly. Without taking expert advice from a broker, you risk paying thousands of pounds more than if you had been shown a better deal from a broker.

As brokers have access to many more lenders than you would be able to access yourself, it makes sense to use them and save a lot of money. With the majority of brokers not charging mortgage applicants for their services and instead working on commission from the lender, there is usually no additional cost for the applicant.

If you are looking for free expert mortgage advice, look no further as we can help. Get in touch with us by calling 01508 483 983 or filling in our contact form.

Jargon Buster

Understanding mortgage terminology is not always easy, so here is some jargon that brokers may use in more simple terms:

- Affordability check

The lender checks how much you can afford to borrow based on income and expenditure. The calculations for this can vary from one lender to another.

- AIP (Agreement in Principle)

A document that confirms the mortgage lender will allow you to borrow a specified amount. An AIP document is often used as evidence to the seller that the potential buyer will be able to afford their property.

- APRC (Annual Percentage Rate of Charge)

The APRC shows the entire cost of the mortgage and includes all interest and any fees from the lender. The cost is based on paying the mortgage over the term agreed, so it can be used to compare deals over the same length of term.

- Arrangement fee

The fee that the lender charges you for setting up the mortgage. You will usually have the option to pay it upfront or add it onto the loan and pay as part of your monthly payments. When it is added onto your loan, you will be paying interest on it.

- Arrears

If you miss any mortgage payments, these are classed as arrears. Your lender will have a set process of actions they take depending on how many payments are missed. This can result in your home being repossessed if payments are not made.

- Base rate

The interest rate that is set by the Bank of England and affects tracker rates and standard variable rates. The base rate sometimes changes, it was as low as 0.25% in 2016 and was as high as 15% in 1989.

- Buildings insurance

The insurance policy that pays for any damage to your property’s structure. A mortgage lender will require you to have taken out buildings insurance to protect their loan.

- Buy-to-Let

A type of mortgage that is taken out when the property owner is buying the property, but letting it out rather than living in it themselves.

- Capital

The overall amount of money you borrow from a lender to buy a property.

- CCJ (County Court Judgement)

If you have failed to pay an outstanding loan, the lender will usually register a CCJ court order against you. Having CCJs affects your credit profile and can mean that some lenders will not be prepared to provide you with a mortgage.

- Conveyancing

When you buy a property the legal process involved is called conveyancing.

- Deposit

The deposit is the amount of money that you put towards the cost of a property. Most lenders will ask for a minimum of 5% deposit before they provide you with a mortgage loan. To access the more competitive loans with lower interest rates, a larger deposit is required.

- ERCs (Early Repayment Charges)

If you want to pay off your mortgage early (i.e. when you sell your house or change mortgage deal) you may need to pay an ERC. Usually ERCs only apply for the fixed rate part of the deal.

- Equity

The equity is the amount of the property that you actually own. This is calculated by subtracting the amount you have paid (in deposit and repayments) from the mortgage loan.

- Fixed rate mortgage

This type of mortgage has a fixed interest rate for the amount of time agreed, which will typically be two, three or five years.

- Freehold

A freehold property is where you own the land rather than a third party that you lease the land from.

- Gazumping

When another buyer puts a higher offer in on the property that you have put an offer in for and the buyer accepts their offer.

- Guarantor

A guarantor can act as a guarantee to the lender that the monthly payments will be made. A parent or guardian is able to act as a guarantor on some types of mortgage.

- Help to Buy

A government scheme that aims to help more people to afford homes. The Help to Buy scheme is no longer offered to new applicants as of 2024.

- Homebuyer’s Report

This is the survey that is completed before buying a property. It checks for any issues such as damp, subsidence and out of date electrics etc.

- Interest-only mortgage

A mortgage where just the interest is paid and not the capital. At the end of the mortgage term, you will not own the property and will need to then buy the property.

- Intermediary

An intermediary is a third party such as a mortgage broker who helps arrange a mortgage, usually taking commission from the lender for their services.

- Leasehold

The land that your property is built on is owned by a landlord and you must pay rent for the land, usually once a year.

- LTV (Loan-to-Value)

The ratio calculated between the property value and the amount of your mortgage. Better deals are available for people with a better LTV ratio (for example, borrowing 60% or less).

- Mortgage deed

The mortgage deed is the legal document to confirm the mortgage agreement.

- Mortgage Illustration

The document supplied by the mortgage lender that details the mortgage offer and enables you to compare the product to others.

- Mortgage term

The length of time that you take the mortgage agreement out over, often 25 or 30 years but this can vary.

- Negative equity

Where you owe more on your mortgage than your property is worth. This can happen when property values drop.

- Overpayment

Where you pay more of your mortgage than the amount agreed. Some lenders will penalise you for doing this but it generally allows a borrower to pay their mortgage off faster and pay less overall interest.

- Porting

Where you transfer your mortgage from one property to another, without the need to take out another mortgage agreement.

- Remortgage

Taking out a new mortgage without moving house. There are different reasons for remortgaging, including moving to a better deal and releasing equity in your property.

- Repayment mortgage

The standard type of mortgage where you pay both the interest and the capital repayments, as opposed to interest-only where you only pay the interest off.

- Stamp duty

A tax that is paid when buying a property. This is currently applicable to properties with £125,000 or more.

- SVR (Standard Variable Rate)

The rate that the mortgage reverts to once the fixed or tracker rate period finishes. People usually look for a new mortgage deal once the deal reverts to the SVR, as it will usually be higher than the interest they can get on a new deal.

- Title deeds

A document that shows the ownership of the property.

- Tracker mortgage

A mortgage with a variable rate that tracks the base rate, i.e. if the base rate goes up by 0.25%, so do the monthly mortgage payment.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Should I Use A Broker Or Go Direct?

- How To Not Get Ripped Off By A Mortgage Broker

- Advantages Of A Mortgage Broker

- The House Buying Process

- What Is A Guarantor Mortgage

- Should I Use My Estate Agents Mortgage Broker?

- What Proof Of Income Is Needed For A Mortgage?

- What Should I Ask When Buying A House?

- What Is An Offset Mortgage?

- How Much Deposit Do I Need For A Mortgage

- What Are Solicitor Searches?

- Everything You Need To Know About Buy To Let

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757